The global financial crisis of 2008 has permanently altered the asset management industry.

From tighter regulations to political uncertainties, it has been through trying times. According to an analysis by Casey Quirk, operating margins of the industry declined by 5% annually, between the 2016 and 2018 period. Several wealth managers have announced cost-cutting measures, including layoffs.

However, growing private finance, rising economy and strong equity markets have seen an average annual increase in Assets Under Management (AUM) by 6.9%, in the same period.

The reasons for this stark contrast between profit and asset growth has a lot to do with the emerging trends in the asset management industry that you should know.

1. Shift towards self-investment options

The intergenerational wealth transfer from baby boomers to millennials is creating a new wave of opportunity for asset players. Millennials are increasingly embracing online investment options and considering self-investment, as they perceive traditional asset firms to be innately bureaucratic. However, only 24% of millennials are financially literate enough to manage their wealth.

Asset management firms are eager to get in the good books of these new HNWs. By developing highly-personalized educative and transactional experiences, these firms can combine the simplicity and transparency of the digital, with the human support of a wealth advisor, to win over this new cohort.

Investment firms like Vanguard and Blackrock are already working to deliver a more lucrative experience and low-fee products like ETFs.

2. Tighter regulations

Changing demographic patterns and macroeconomic conditions are highly affecting how global asset firms navigate through multiple regulatory regimes. With the repercussions of the global financial crisis still being felt, regulatory bodies continue to protect the interests of customers first. The MiFID II directive enforced across the EU is a fine example.

With declining fees and rising compliance spends increasingly becoming a trend, asset firms need to continuously recalibrate their offerings to align with investors’ wants and needs, in order to protect and drive profits.

By determining their product range, target markets, and distribution channels, asset management firms can proactively deal with regulatory risks, and effectively strategize to grow their revenues.

3. Fintech competition

The rise of fintechs has made wealth management services increasingly affordable, transparent, and accessible. With fees starting from zero to 0.25% robo-advisors and other fintech startups are capitalizing on a vast, previously underserved demographic of low to medium net worth investors.

In 2019 alone, the AUM in the robo-advisors segment amounted to USD 980,541 million. WealthFront, Betterment, and Personal Capital are leading players that asset management firms can join forces with, to enhance their digital proposition and servicing capabilities. Besides this, AI is helping fintechs monitor market sentiment of trade assets, and forecast movements to deliver personalized customer guidance.

Blockchain, however, threatens to substitute traditional asset management tasks such as portfolio management and client advisory, with new autonomous financial instruments and automated investment vehicles built on smart contracts.

4. Evolution of global investments and emerging markets

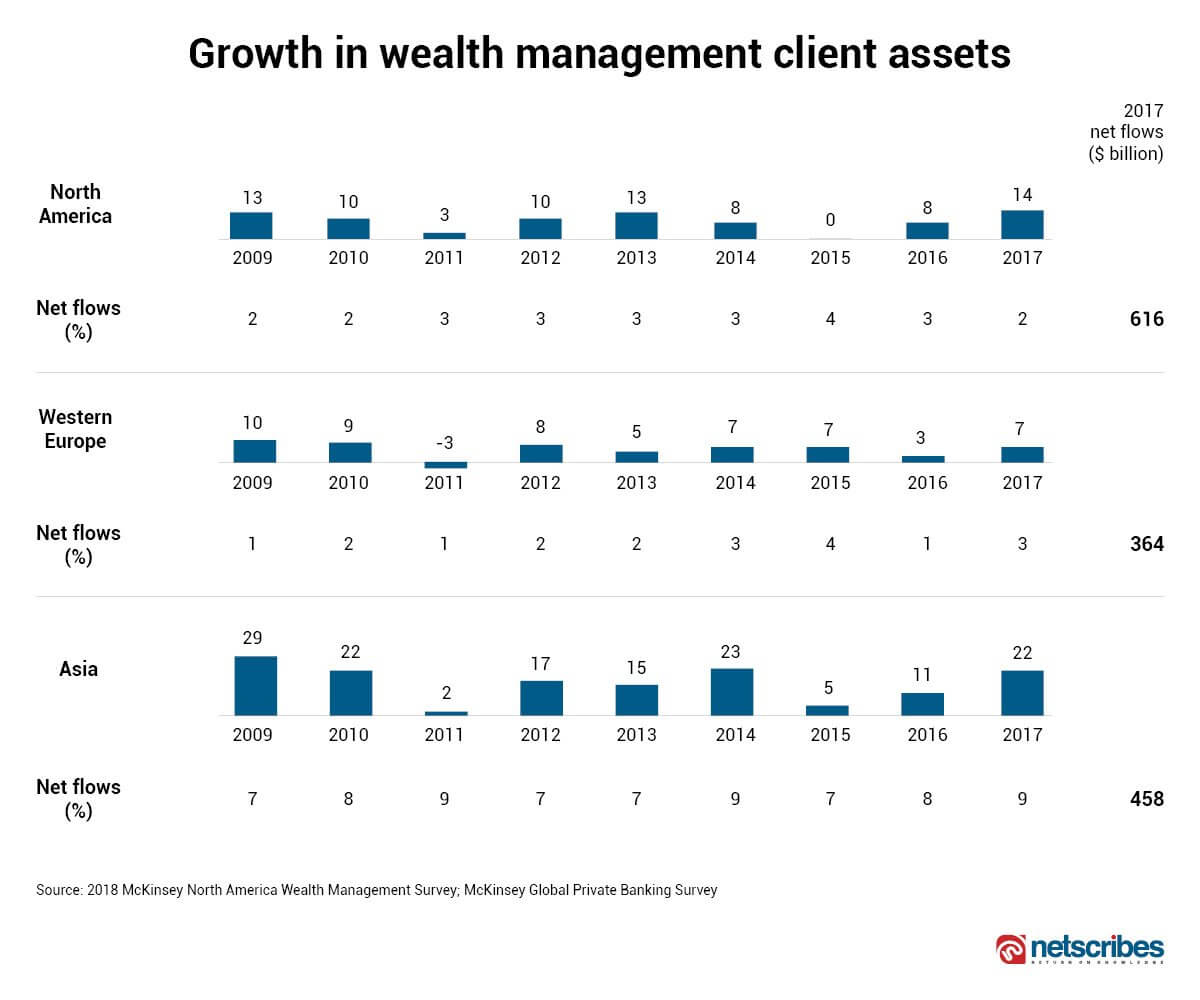

Global wealth management assets are at an all-time high with Asia leading the league as the fastest-growing region. The US stands similarly strong-founded on rising interest rates, market appreciation, and asset transfer to fee-based accounts.

However, organic growth and profit have been plummeting as a slew of firms struggle against the strong winds of reduced fees, since 2016. With more wealth transfers expected from developing regions to developed economies, asset management firms need to focus on scaling their capabilities across both geographies, in order to gain a substantial market share.

The future is set to witness pay-for-performance fees replace brokerage models, automation of transaction-driven processes, and increased emphasis on updating skillsets for asset management advisors. To survive this disruptive digital tide, wealth firms must consider strategic fintech collaborations and elevation of their capabilities to keep up with evolving client expectations.

Netscribes helps global asset management companies understand the impact of macro-economic conditions and evaluate the competitive value of emerging technologies. To know how we can help you drive informed investment strategies focused on revenue growth, contact us at info@test.netscribes.com