As major commercial banks embrace cutting-edge technology, they redefine their industry at large and the way they do business. Specifically, we are talking about disruption through open banking, which is paving the way for collaboration between fintech enablers and traditional financial institutions. Let’s take a closer look at how fintech companies are preparing for a digital future.

It is a relatively new financial service through which third-party service providers can access consumer banking, transactions, and other financial data from banks and non-banking institutions utilizing APIs and application programming interfaces. In fact, PwC research shows that open banking will create revenue of £7.2bn in 2022.

What is open banking?

Open banking is essentially a term used for non-banking institutions offering banking services. As a result, customers can grant trusted third parties access to their data. How does an open banking system work? Everything starts with the data; primarily the data banks use to share customer transaction data with third parties in order to develop personalized, case-specific offers. These are the main advantages of open banking. Despite the open banking concept, the banks share relatively little personal data. Financial transactions are not extended beyond what’s possible through a bank’s mobile app or branch office.

Open banking vs open finance

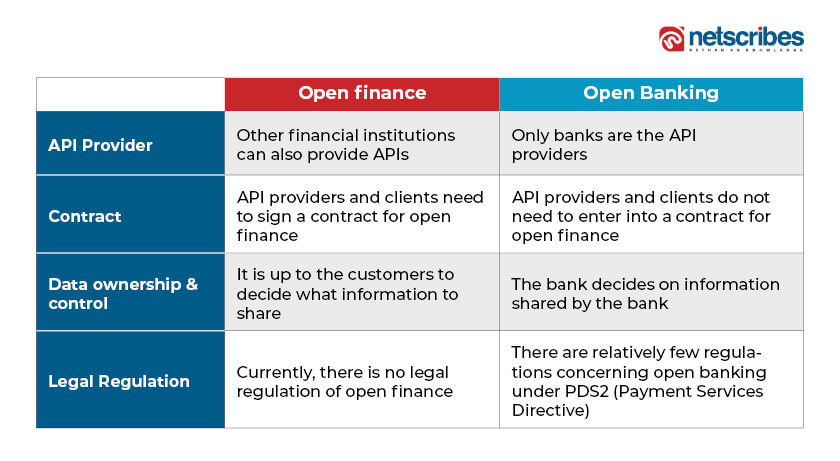

The next step in the development of open banking is open finance. While open banking offers limited benefits since third-party providers can access only a small portion of consumer data, open finance gives them a complete picture based on customer data.

By contrast, open finance suggests gathering all of the users’ financial data in one place. The term includes banking transactions, insurance, money transfers, investments, and crypto deals. Some of the other differences between the two have been listed down below:

What does this transition mean for the financial industry?

The year 2021 was full of innovations and changes in how financial institutions and their markets interacted. Banks and their customers have used digital tools and processes to compensate for the closure of branches, office locations, and call centers following the COVID-19 crisis.

The financial services industry has a digital strategy in place for every organization, but this has become an accelerator that has permanent effects. As a result of this wave of innovation, some pretty large disparities emerged between how consumers manage their finances and the innovations that keep popping up.

Banks faced an overarching challenge in balancing traditional approaches to risk management with the need to respond quickly to a crisis that changed their markets dramatically.

In addition, cybercriminals started using phishing attacks and fraud to make money. Additionally, as all banks began using Zoom and other similar platforms, banks also had to tackle emerging risks such as video and voice communication. Third and fourth parties have been victims of cyber-attacks as well as controls for the use of personal equipment.

In this context, open banking becomes critical.

A MasterCard report states that open banking should not be confused with digital banking and that two large changes are occurring in the financial industry. One is that several non-banking organizations have been instituted in order to meet the growing requirements of the financial consumer.

The other big change is that traditional banks and other big players are changing their business models to become more customer-oriented, create hyper-personalized services, and scale up with highly agile niche startups and firms through cooperative competition.

Small businesses are increasingly adopting open banking practices. Financial technology companies provide services to SMEs and traders, such as opening checking accounts, transacting in multiple currencies, and making cross-border payments.

For SMEs, setting up an account with such fintech can be a good idea, particularly if they conduct international business. For example, a Hong Kong-based company called NEAT allows SMEs to open checking accounts and begin a business in only a few days.

What challenges is open banking helping traditional banking companies overcome?

The year 2021 saw a significant shift towards online channels and the adoption of new digital habits. Consumers and small businesses turned to Fintech apps and other non-traditional financial products and services. It is important to note that data here is the key part of the puzzle.

Financial service players can gain customer attention by using open data to drive open banking and finance. As a result, they can offer their customers better financial products – and, more importantly, be the first ones to do so.

The biggest challenge in banking and finance that has been resolved by open banking and finance is flexibility. Consumers now have creative flexibility when managing their finances, can practically deal with their accounts, and can make payments easily. You can even choose from a variety of services when it comes to financial services: payments, small business loans, credit cards, bank accounts, and more.

Singapore, for example, has issued banking licenses to five non-banking companies. One of these is the consumer internet company, SEA, and the Grab ecosystem, which boasts 8 million users worldwide. With those licenses, and the ability to research online behavior and digital behaviors, these companies can provide financial services directly into their customers’ daily lives.

The open banking movement has also benefited service providers and motion companies. The software can take care of some of the hassles associated with registering new customers, increasing loyalty with existing customers, and completing purchases. Retailers can target their point of sale offers and promotions according to consumers’ spending habits.

In addition to displaying account balances and electronic receipts, consumers can take advantage of several account information services by using embedded APIs in existing point-of-sale channels. A similar platform can allow retailers to pay their customers directly from their banks.

Banking can dramatically improve customer experience by using APIs at all levels of their services in order to maximize the use of data and speed up and refine operational processes. Banks can gain access to expertise and technological innovation outside their company with APIs, which make collaborating with third-party financial service providers easier. This means lower transaction processing fees and faster funds clearance.

Related reading: 8 Fintech trends to watch for in 2022

What’s next in this space in the near future?

Open banking and finance have reshaped global financial services; it was a pivotal year for open banking in 2021, with 4.5 million UK users adopting the technology and 18.8 million European users joining. This technology is expected to become more mainstream in 2022. As customers authorize its use, fintech companies and banks can provide more accessible credit, financial management tools, and digital wallets.

It is interesting to watch this rate of acceleration and see where it will lead us next. This approach seems to hold a great deal of potential, but it lacks certain necessary mechanisms, and there are concerns over its security. We must also consider that 2022 is only a starting point and that a transformation of such magnitude will take time.

To stay up to date with the latest trends, gain in-depth market insights on the financial services sector, and obtain customized insights for your organization, contact us today.