Mergers and acquisitions have been a proven strategy for driving long-term growth for companies. M & A activities have been rising exponentially over the years and in 2020, the global deal value exceeded USD 3.5 trillion. With the ongoing wave of technology disruption, inorganic growth has become an essential tool to acquire capabilities. Companies have been revisiting their goals to continuously evaluate acquisition opportunities to integrate new capabilities across both core and adjacent sectors.

The recent global deals have evidenced that during this wave of technology disruption, acquirers are adopting an M&A approach to gain higher market share, increase capabilities to further customer stickiness, and improve wallet share. In 2020, the technology sector witnessed a deal value of over USD 680 billion, growing 50% year on year.

Recent M&As echo a strategic semblance

The recent example of Microsoft acquiring Affirmed Networks for new cloud-native capabilities that were difficult to develop organically, shows the potential of a right inorganic growth strategy. The acquired cloud-native portfolio has not only allowed Microsoft’s entry into the telecom sector but also equipped the company with capabilities that define the current need of the telecom market.

Hitachi’s acquisition of GlobalLogic, Qualcomm’s acquisition of Nuvia, Accenture’s acquisition of Cygni, and Panasonic’s acquisition of Blue Yonder are a few examples of how companies are continuously pursuing acquisitions to diversify their portfolio and maintain a competitive advantage.

When evaluating these potential technology-centric acquisition targets via an M&A analysis, the objective is not only to identify the business viability for enterprises, but also determine their technical capabilities and fit with existing product offerings.

For buyers, it is crucial to get a deep-dive insight into how new capabilities can be evaluated based on their true technical competence and potential. In the last five years, niche areas of opportunities associated with innovative technologies have opened up, compelling large companies to closely and consistently track and understand upcoming technologies. Acquisition in domains like 5G, neuromorphic cameras, edge computing, electrification, virtualization, LiDAR, digital health, and other areas require domain expertise alongside a holistic business viewpoint.

Persisting acquisition challenges

At present, the top issues acquirers face include – (i) Inadequate in-house capabilities to assess the deals targeted on emerging areas and (ii) Deep-diving into differentiating factors of the target companies from a technology competence standpoint, down to the patent level, and thus estimating future compatibility and revenue synergy potential.

In a highly competitive environment, companies want to gain better insight into M&A actions and investment opportunities in emerging technologies. A critical requirement for any company in this vein, is to leverage domain expertise to deftly evaluate sectors such as semiconductors, automotive, telecommunications, chemical, healthcare, and electronics.

All this to finally develop end-to-end M&A analysis assessment, for identification and evaluation of potential acquisition targets. Subject matter experts, who have worked with marquee global technology firms, innovators, and investment firms are guiding global entities to create data-driven acquisition and collaboration strategies.

How we help

Netscribes’ approach involves a comprehensive research methodology and linking of the findings with our deep understanding of technology and business aspects of firms across industries. Focused tracking of technology areas and innovative companies; critical insights into how a potential industry collaboration could evolve into an acquisition; assessment of startups or spinouts that could create a bigger impact in the market in the long-term, are a few instances of our work cases.

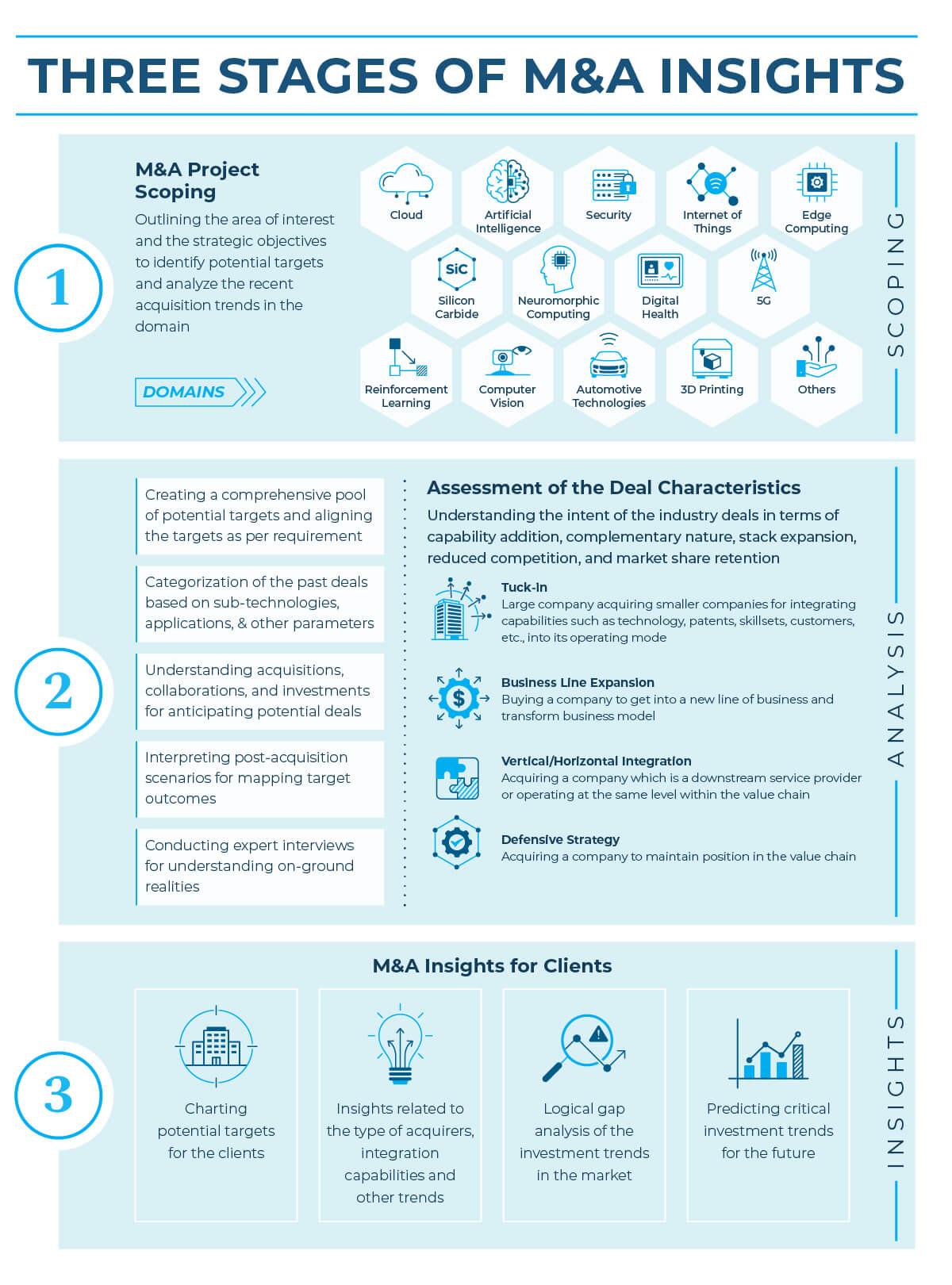

For a detailed M&A analysis, we follow a structured methodology to understand the prior acquisitions, capture the deal rationale, and outline potential targets with distinctive possible categorizations.

A case in point

When one of our technology clients was looking to expand its business in the African region, the primary objective was to understand investment opportunities related to the local companies in the internet service providers (ISP) domain. Assessing the overall demand, consumption, and competitive scenario in the space were the key priorities. One of the important goals of our client was to enter a new market to penetrate into emerging technology domains with an early acquisition or investment in the region.

The key challenges of the client were getting a ground-level picture the government policies, a clear understanding of past acquisitions and analysis of foreign and local investments to support ISP businesses.

Netscribes’ comprehensive methodology combined the assessment of macroeconomic factors, competitive scenarios, regulations, alongwith market demand, and a GAP analysis to outline several recommendations.

We conducted interviews with the regulators, SMEs, start-ups, and other solution providers to gather information related to growth strategies, financial management, operational management, challenges, pricing, spectrum utilization, and funding. Based on the detailed data pointers of our M&A analysis, we defined potential targets for acquisition and new partnership opportunities in IoT, edge computing, satellite, and artificial intelligence.

Insights into government policies that are realistically advancing or limiting the activities of new entrants, enterprise requirements, and 5G deployment in the region equipped the client to devise phased-out strategies for the next 5-10 years.

Netscribes has provided data-driven innovation insights for over two decades, enabling organizations to navigate the market faster and stay on budget. Our patent analysis, technology assessments, and qualitative and quantitative research support you throughout the M&A analysis process – from proving the novelty of your inventions to securing commercialization. To know more contact us.