No business is immune to competition. That said, most organizations conduct competitive intelligence internally in ways they’ve best known. However, this has left many in the lurch, as to where to begin, which sources to look at, what aspects to cover, and how to ethically assimilate and analyze data to derive meaningful insights. Treading down this path may leave some major sources untouched and some fundamental gaps or blind spots in the process.

Often a competitive intelligence activity is undertaken as a reflex to a rival’s success. However, to thrive in today’s hyper-competitive business environment, companies will have to look beyond their rival’s next move to be the market leaders of tomorrow. So how can you leverage a robust competitive intelligence to steer your business decisions effectively? Take a look at these 4 essential steps that form the crux of any competitive intelligence activity:

1. Identify the needs of key decision makers

For a business’ key stakeholders to arrive at a calculated resolution, it’s highly important for them to be able to substantiate their choices with data. A clear understanding of their objectives will not only help you to look for data in the right places but also help determine when to stop researching. The research must also factor in the feasibility of assimilating accurate data, its costs, and the metrics that will help determine research effectiveness. Some of the most popular objectives to date have been one or a combination of the following:

- Identify unmet customer needs

- Inform market entry strategy

- Uncover market opportunities

- Evaluate the effectiveness of their rival’s positioning and messaging

- Map their rivals to enhance their channel development strategy

2. Gather information on internal and external influencers

As a business, being aware of the different competitive forces that affect you from within and outside your industry is key. This means keeping a close eye on regulatory, environmental, social, and economic factors that could impact your business performance. A constant tab on news updates from the government and regulatory bodies, local and global news highlights along with timely reports on environmental shifts will gear businesses to take prompt and strategic calls. Apart from that, here’s a roundup of the main facets that comprise of a competitive intelligence study and how to get started:

a. Competitor analysis

Identifying your direct and indirect competitors, the markets they are present and their partnerships is crucial. Company press releases, online corporate databases (paid and free), trade shows and magazines, industry publications, financial analysis, and syndicated reports are some key places to look for such data. Additionally, following your competitor’s digital footprints like their website and other sources like industry review sites, job boards, etc., can provide a holistic picture of their current activities.

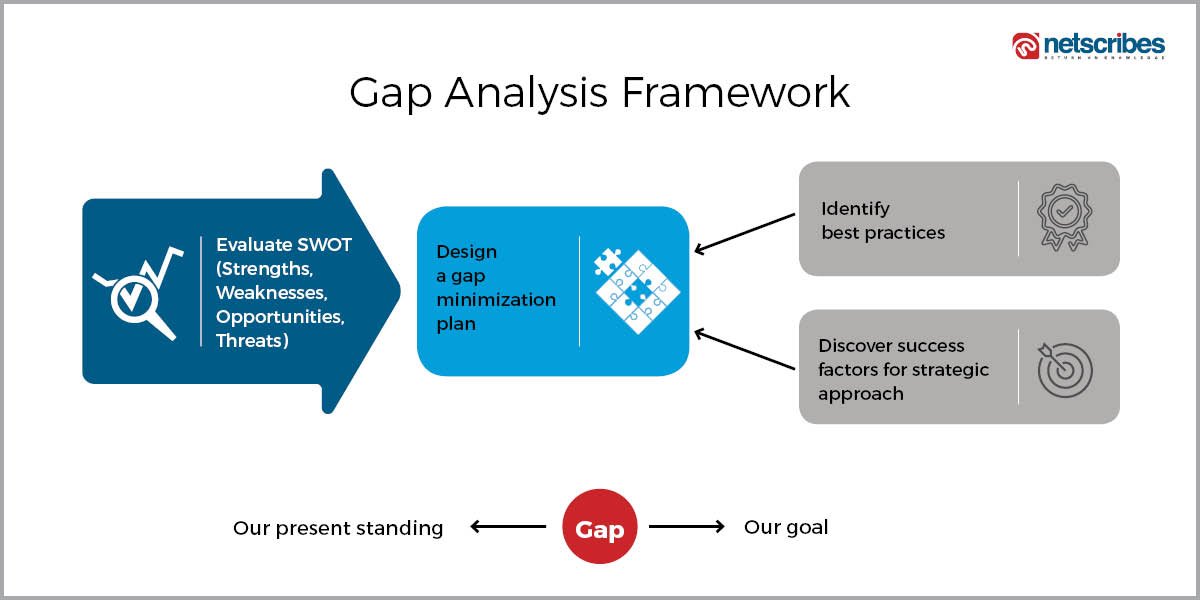

b. Product benchmarking and gap analysis

Brands today are seeking to differentiate themselves by providing services addressing a market that couldn’t be served before. It’s quite rightly said – ‘Opportunities are never lost; someone will take the ones you miss.’ A product comparison using metrics like market relevancy, strengths, limitations, and enhancement options, will help stakeholders drive future-proof and customer-centric product development strategies. Businesses can look at consumer reports and also conduct an A/B product testing to understand prevailing consumer preferences.

c. Technology analysis

Technological innovations are improving the efficacy of certain offerings while rendering others obsolete. A constant pulse of potential industry disruptors and their IP will reveal where the market is headed and what you need to do to keep up – whether it’s upgrading internal system architectures or engaging your customers with tech-enabled fluid experiences. Monitoring your rival’s technology partnerships through industry journals and press releases will help you navigate the market competitively. However, pre-empting their moves is crucial for a true proactive advantage. This will require a close technology watch – involving domain experts who have foresight into reigning technologies being patronized within your industry.

d. Customer analysis

There’s a great deal to learn when your customers call in to complain or post negative feedback on social media or online forums. A deep-dive into these channels through social listening tools will help stack up your strengths and weaknesses against that of your rivals. Online customer surveys and mystery shopping help uncover customer sweet spots. Looking at your rival’s customer support threads, as well as their case studies can also offer pertinent insights into their focus areas of operation and target markets.

3. Analyze and synthesize the information

After you’ve collated the information, structure it to draw the output based on your research objective. Next, frame problems and look for connections in your data to arrive at potential solutions. To analyze volume-based data like sales figures across geographies, you will need to leverage certain tools and algorithms to get the desired output. Restructure your data if needed. Create war rooms to discuss, articulate, and capture your findings. Generally, these unveil certain patterns in this process. All these findings must then be designed into a visual and consumable report.

4. Disseminate these insights to decision makers

It’s important to remember that all data comes with a limited shelf life. Therefore, to leverage competitive advantage, stakeholders must have prompt access to this intelligence. Also, try and design reports that let decision makers modify and filter certain parameters to derive the insights they need. Finally, to truly watch your competitive intelligence in action, these insights should permeate through all levels of the hierarchy – from sales to customer service.

From culling information from undefined, disparate sources to synthesizing it to offer competitive insights for various stakeholders, there’s no doubt that the process is a complex and time-consuming one. That’s why leading enterprises trust Netscribes to gain timely, accurate and actionable market intelligence to drive sustained business decisions. Speak to us to request a consultation.