The global meat substitutes market is rapidly emerging as a highly popular segment within the F&B industry. Netscribes estimates that the global meat-substitute market will be valued at USD 6.1 billion by 2023. The reasons for this thriving market are manifold, including a gradual shift towards vegan diet, mainly in the US. The tofu and tofu-based segment are the largest in this industry, having generated USD 1.8 billion in 2018 alone, followed by TVP (textured vegetable protein) and seitan. Here’s a look at some of its growth drivers, challenges, and key trends impacting the global meat substitutes market.

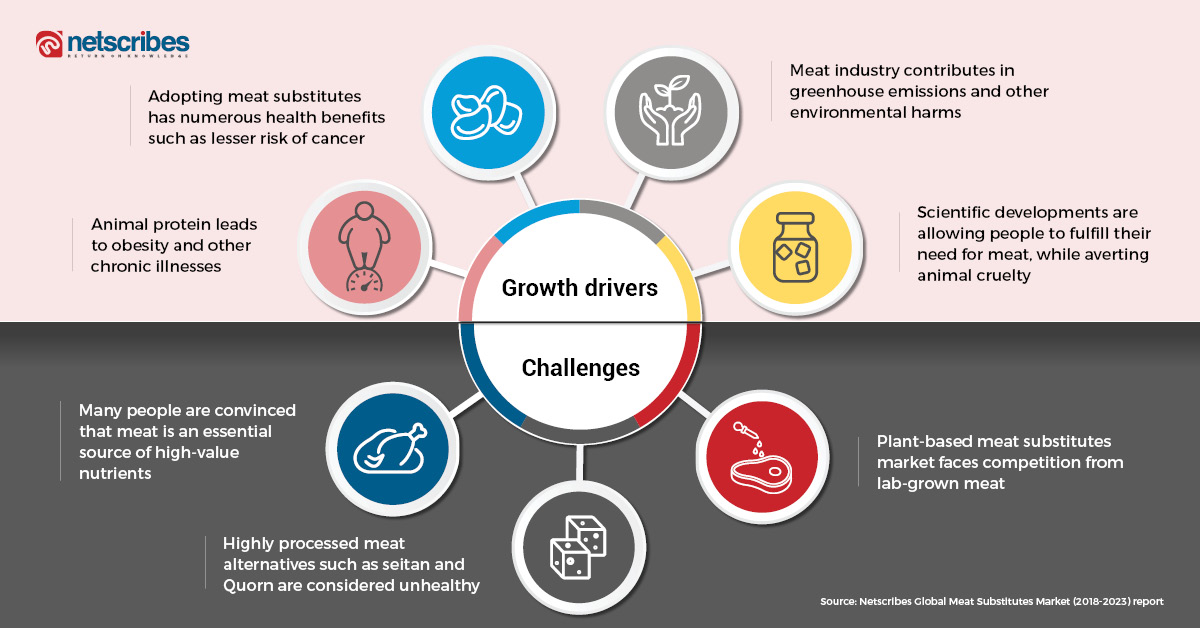

Growth drivers

The link between obesity and meat consumption

Digestion of animal protein takes more time than fats and carbohydrates, and the surplus energy from such protein is stored as fat in the body. Obesity, in turn, can lead to various chronic diseases such as diabetes, heart diseases, and even certain types of cancer. These findings have been made public, driving people to switch to meat substitutes, thus fuelling demand growth.

Health benefits associated with meat substitutes

Incorporating meat substitutes in the daily diet is associated with numerous health benefits like low cholesterol levels, and lesser risk of cancer and heart diseases, among others. These factors, combined with consumers’ need to lead a healthy lifestyle is contributing to market progress.

Environmental impacts

The meat industry causes a plethora of environmental harms ranging from deforestation, acid rains, coral reef degeneration to land and water degradation. Livestock farming has been known to contribute 18% of man-made greenhouse emissions, causing climate change. These factors have caused a great deal of concern among consumers making the plant-based diet switch more compelling.

Scientific advancements to introduce innovative products

Thanks to scientific developments, fulfilling the need for meat, devoid of environmental harm is being achieved by producing convincing fake meats, that contain both its texture and taste. For instance, a California-based start-up launched a completely plant-based burger that tastes and bleeds like real meat.

Challenges facing the global meat substitutes market

Public perception regarding a no-meat diet as having a low nutritional value

Old age perception dictates that meat is a source of high-value nutrients such as proteins, minerals, and amino acids. This essentially makes meat-substitutes appear to be less beneficial for health. In countries such as China, the United States (US), and Indonesia, consuming meat is a part of the daily diet and has been a long-standing tradition. This makes it hard for companies to market meat substitutes in these geographies.

Highly processed meat alternatives considered unhealthy

Consumers nowadays prefer healthy and organic food over processed options. Meat substitutes like seitan, Quorn, and tempeh are highly processed food items and hence are often considered unhealthy. This leads consumers to often opt for vegetables, legumes, and pulses rather than meat substitutes for their protein-requirements.

Competition from lab-grown meat products

Adverse environmental consequences and the loss of animal lives are some of the key motivational factors behind people preferring meat alternatives. But the plant-based meat substitutes market is facing competition from lab-grown meat. The lab-grown meat is less resource-intensive and uses 80% less water per gallon, and 80% lesser greenhouse gas emissions per pound of meat. The innovations in the lab-grown meat technology can deliver similar benefits of plant-based fake meat products. This can trigger a segment of consumers purchasing plant-based meat substitutes to make the switch to lab-grown meat products.

Market trends in the global meat-substitute market

Variety of raw materials used in the manufacturing process

A range of raw materials are used for producing alternative meat products, primarily from soy and wheat to recognizable, clean-label ingredients, and high-quality protein that even non-vegans and non-vegetarians can enjoy. For instance, Quorn, which is used as a substitute for minced meat is derived from mycoprotein, plant-based fungi extracted from soil, which is in high demand for being rich in nutrient content and superior in taste.

Extensive R&D and innovation

To satiate consumers eager to be vegetarians, companies are investing in R&D to bring meat products that look and taste similar to meat. These companies are constantly raising the quality standards, and successfully appealing to the meat-eater segment while inspiring the overall growth of plant-based food products. For instance, brands like Beyond Meat and Impossible Foods did their due R&D while developing their meat substitute products to ensure it looks and tastes exactly like meat.

The advent of fish-alternative products

One of the major trends that the forecasted period will witness is the increase in alternative products for fish – a fairly neglected area in the past. There is a lot of potential and demand for seafood alternatives, and companies like Good Catch are all set to launch vegan fish and seafood options in the market.

For an in-depth market competitive analysis and technology research on the global meat substitutes market, contact info@test.netscribes.com