The footwear market in India has been drawing prominent spotlight in the fashion and style industry and is expanding significantly. According to Netscribes, the Indian footwear market will be worth INR 790.6 billion (USD 11 billion) by 2023. By leveraging accelerated internet penetration and the rise of e-commerce, footwear manufacturers are driving sales and understanding customer behavior. Here are some of the growth drivers, challenges, and key trends influencing the Indian footwear domain.

Growth drivers

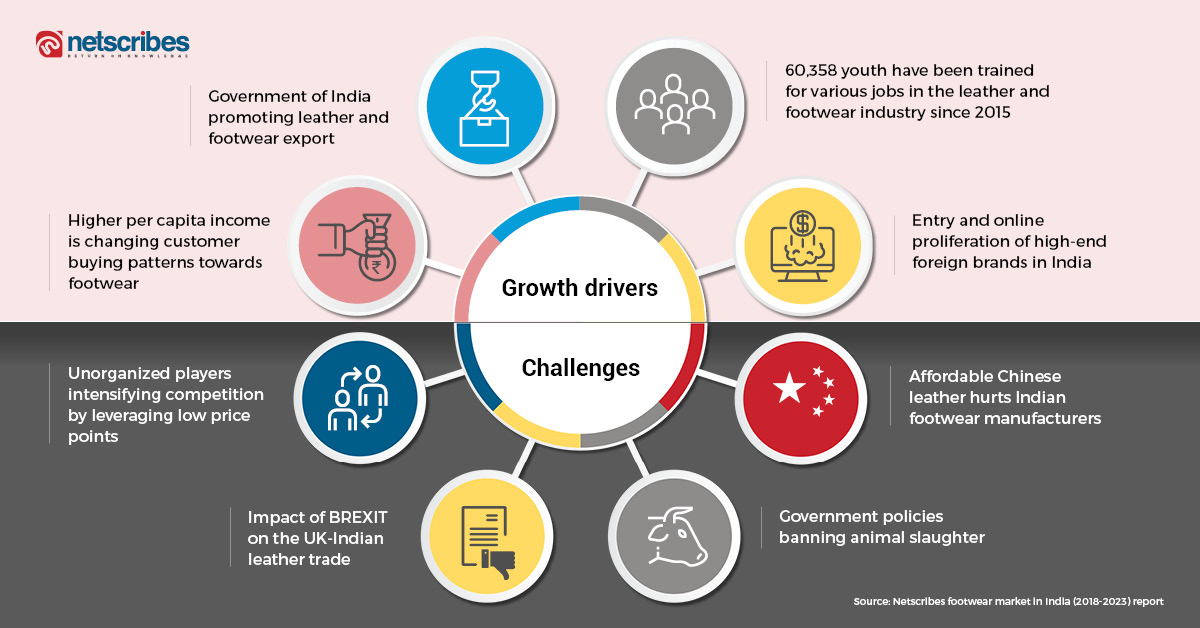

Increasing disposable income and economic growth

The growth in disposable and per capita income has revolutionized customer buying patterns towards apparel and footwear. A significant number of the urban population, mainly in tier I and II cities have considerably higher spending power. This is a major reason for the growth of the footwear market.

Government initiatives

The Indian footwear and leather industry is export-oriented and the government is taking initiatives to increase the leather and footwear export to INR 900 billion (USD 12.6 billion) by the end of 2020. The government has also announced INR 26,000 million (USD 364 million) incentive package for the leather and footwear industry. This will help players operating in the organized sector better deal with pricing pressure, along with employing 300,000 people. Under the National Sill Certification & Monetary Reward Scheme, around 60,358 youth have been trained for various jobs in the leather and footwear industry since July 2015.

Growth in modern retailing and e-tailing

Accessibility, a wide range of choices, and special coupons and discounts attract customers to modern retail. High-end foreign brands are penetrating the Indian footwear market through retail channels with a better distribution network.

Premium and luxury segment footwear brands like Aldo, Charles & Keith, Pavers England, Hush Puppies, Clarks, Gucci, McQueen and Yves Saint Laurent (YSL) are all available in India either through exclusive stores or through multi-brand outlets. With an aim to boost market visibility and retain these tech-savvy customers, major footwear giants like Reliance Footprint and Bata are expanding their market presence online.

Challenges facing the footwear market in India

Tough competition from unorganized players

Nearly 85% of the Indian footwear industry comprises of unorganized players. These players sell their products at unimaginably low prices and have benefits such as lower sales tax, lower overhead cost, lower labor cost and absence of research and development (R&D) expenses. This will intensify competition as organized players will pass the price benefits to the consumers, while unorganized players try to enter the organized space.

Sluggish growth of the Indian leather footwear market

The UK is one of the leading export destinations of Indian footwear. However, with BREXIT affecting the value of the British pound (GBP), it has impacted the Indian leather export. Furthermore, government policies banning animal slaughter on leather tanneries have impacted leather availability. Lack of leather availability and BREXIT has led to a decline in export figures by nearly 4% in 2017.

Import from China

63% of leather imported comes from India’s neighbor, China. This hurts the Indian footwear manufacturers as Chinese leather is cheaper and is sold in the unorganized retail market without sales tax and creating a loss for the economy.

Key trends in the footwear market in India

Automation in the footwear market

Traditionally, creating footwear involved a mammoth amount of manual work, mainly in sewing and making the uppers. Often it would take 18 months, from forecast to delivery, making it hard to meet supply with demand. But with the advent of automation in the production line, footwear production has become more reliable and efficient.

Renowned brands have long resorted to automated production. Previously, these companies produced footwear based on what was to be delivered in the next six months, but now they are operating on the basis of what customers are presently buying. Now for them, the time taken from manufacturing to delivery is about 10 to 60 days and sometimes even lesser than that.

Omni-channel strategy

With footwear evolving from a basic requirement in day-to-day life to a symbol of fashion and style, it is necessary for the players to ensure synchronization across all the platforms, to reduce operational complexities and serve customer needs effortlessly.

For instance, The Adidas group has integrated 200 out of its 750 stores with the help of ‘Endless Aisle’ technology, in which it has geared its Adidas and Reebok brand stores with iPads through which shoppers can order for products that are out of stock at their physical stores. This helps seal the deal on a prospective sale ensuring a maximum of their outlet walk-ins convert.

For an in-depth market competitive analysis and technology research on the footwear market in India, contact info@test.netscribes.com