Quick. Simple. Connected. Consumers expect this in all their digital activities, including payments. Convenience is key, and businesses are delivering it. This has led to a rising trend of embedding financial offerings into existing products or services by non-financial companies. For consumers, this means getting access to financial services directly from platforms.

Over the past year, non-financial companies have increasingly integrated financial solutions into their offerings. From e-wallets, accounts, and payments to investments and lending, embedded solutions are penetrating every aspect of financial services.

Set to grow by 39.4% annually, the global embedded finance industry is expected to reach US$241,018.2 million this year. Forecasts indicate a steady growth rate CAGR of 23.9% during the period of 2022-2029.

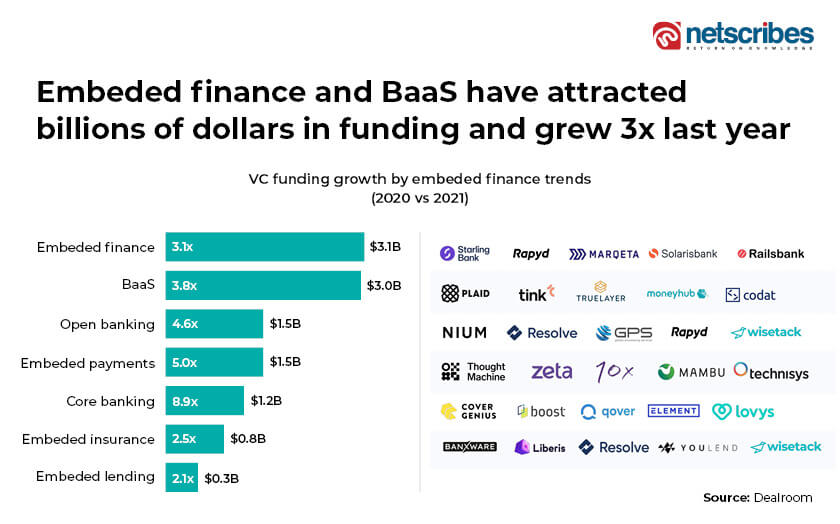

Take a look at the growth trends since the last year. From 2020 to 2021, funding growth more than tripled.

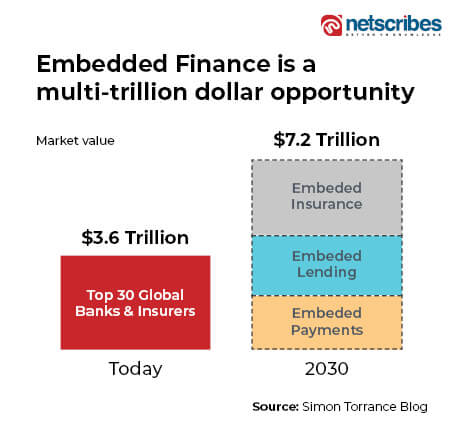

With the potential to unlock an opportunity bigger than the current value of all the top global banks, fintech startups, and insurers, combined, the embedded finance revolution has just begun.

Diving into the workings: How does embedded finance work?

Embedded finance is made possible through a cooperative partnership between three key institutions: a non-financial digital platform, a fintech provider, and a financial institution such as a bank. The fintech company leverages end-to-end software tools to connect the digital platform and the financial institution. Financial institutions enable the seamless management of regulatory, compliance, and credit risk and service loan requests in the embedded finance ecosystem.

One of the simplest examples includes Whatsapp Pay – a feature that lets users send and receive money through its messaging app. Embedded finance is where a traditionally non-financial service integrates or embeds financial services within its platform, thus eliminating different levels of contact for the customer.

What purpose does embedded finance serve?

In the past, users would need to be diverted to a financial service provider at the point of purchase. For example, to purchase travel insurance while booking flight tickets. This friction doesn’t make for a great customer experience. Sometimes, businesses risk losing customers altogether. By embedding a travel insurance plan or a BNPL option into the travel app, customers get a more convenient checkout experience, not to mention the additional revenue stream for non-financial firms through payment fees.

As the digital payments space continues to grow, the appeal of embedded finance will only increase. Today, an increasing number of non-financial businesses like e-commerce players and merchants, and small businesses are embracing this.

Types of embedded finance solutions:

Besides BNPL, embedded finance solutions include:

- Embedded payments: Payments infrastructure is integrated within a platform/app to create a seamless payment flow.

- Consumer lending: Credit products are embedded within non-financial digital platforms. Non-bank institutions can provide loans to consumers within their platforms. BNPL is an example of embedded credit and lending. On Amazon, for instance, at checkout, a consumer can convert their purchase into EMI without having to leave the platform.

- Embedded insurance: This refers to insurance bundling within a product or a service purchase. For instance, Tesla’s auto insurance is offered at the online point-of-sale and during in-showroom purchases.

- Embedded investments: Platforms can offer investment services to their customers and integrate stock market investing into their offerings. Brokerage firms kickstarted the trend with APIs reflecting every microservice from opening an account, trading, funding, market data, and portfolio management.

While several firms are actively hopping onto the bandwagon, many are still struggling to fit payment tools into an outdated infrastructure. But even as a majority have already kickstarted their offerings, what does this mean for incumbent banks?

What embedded finance means for traditional banks

With embedded finance, the financial business model has shifted to a platform-based model. The power of customer connect is shifting from banks to the brands offering embedded services. This presents a challenge for traditional banks. How can they adapt to survive the ever-evolving financial landscape?

Banks will now have to shift their focus and rethink banking-as-a-service. They will need to be ready to take on new roles and expand into non-banking abilities. Goldman Sachs, for instance, is embracing the BaaS explosion, having recently launched Transaction Banking as a service. New offerings and partnerships will take the financial ecosystem by storm, a key partnership being one with Fintechs.

Embedded fintech solutions

Financial institutions are now embedding fintech options into their products and customer channels, such as mobile applications, websites, and business processes, which is a recent trend. Embracing new business models like B2B2B and B2B2C distribution abilities and pay-per-use monetization, among other innovative offerings, will be the way forward for banks to maintain a market edge.

Embedded solutions meet crypto

Late last year, Nium, a leader in global payments and card issuance for businesses, launched the fintech industry’s first global Crypto-as-a-Service (CaaS) solution. Third-party platforms such as this offer flexible solutions and increase crypto accessibility to more financial and non-financial partners. This opens up possibilities for daily transactions in crypto including crypto payments, crypto savings, and crypto investing. Recently, Solarisbank has taken the lead in exploring a new area of embedded finance: crypto-as-a-service or embedded crypto. The recent crypto boom brings up several questions: What are the future possibilities of integrating embedded finance into the larger crypto ecosystem?

In a recent webinar, Julian Grigo, managing director of digital assets, at Solarisbank, elaborated on embedding crypto into their products and offering it in the same B2B2X model. Aside from their regular digital banking services, their crypto-related services include crypto custody, crypto brokerage, and crypto collateralized loans.

Related reading: The future of blockchain in the financial sector

The way forward and future impact of the embedded finance industry

The role of the digital platform: Digital platforms will play a pivotal role in making financial services more accessible to customers. Their vast database and extensive customer data can foster innovation and cater to customer needs in a way traditional financial institutions cannot.

New partnerships: Financial institutions’ partnerships with digital platforms and tech firms will only be the beginning of collaborative solutions. Forging new partnerships enable them to leverage their vast amounts of consumer data to understand existing customers, acquire new customers, drive repeat transactions, tailor financial solutions and improve the margins. By using new sources of data such as platform data, they may be able to approve customers, facilitate advanced underwriting, and explore innovative financial products and services.

The continued growth of vertical SaaS: With the embedded finance infrastructure, SaaS companies can add financial services to their core software products. In vertical markets, customers turn to purpose-built solution software to solve the majority of their problems. With one company already taking care of every software need in that market, a few dominant players in the SaaS market often emerge to fulfill a wide range of customer requirements.

Improved customer experience: The rise of embedded finance solutions has allowed digital platforms across industries to offer financial services. From e-wallets and payment portals, the focus is on an improved and convenient customer experience. There is constant improvement in existing services and accessibility. With services like BNPL gaining momentum, brands will strive to create a one-stop solution for all customer needs and expectations. One platform for product purchase, payment, and customer credit will soon drive the norm.

The financial services sector is only set to undergo more changes and partnerships in the coming years. To stay up to date with the latest trends, gain in-depth market insights on the financial services sector, and obtain customized insights for your organization, contact us today.