Connected vehicles, or automobiles that can communicate with each other via the cloud, is opening exciting opportunities across the globe. Based on digital technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning, connected vehicles not only offer luxurious comfort for passengers but also provide enhanced safety features. In recent years, many Indian organizations have started investing in this industry to gain market share by capitalizing on the growing Indian consumer automobile market. Given the present Indian geographical and research stature, factors mentioned below govern the integration of connected vehicle technology:

- Infrastructure

- Revenue model and monetization

- Growth and acceptance by the community

- Regulatory and compliance changes

Emerging trends in connected vehicle technology

Connected vehicle technologies have a great deal to offer to Indian consumers. Car owners today are empowered with the ability to connect their cars to different mobile applications that offer features such as immobilization of the vehicle in case of theft, alerting the owner of any unintended vehicle movement and location tracking. Such applications can also deliver vital information regarding the vehicle such as oil level, tire pressure, water level, fuel, mileage information, and battery change alerts.

Some Indian organizations have already launched vehicles integrated with connected car technologies. Reliance Jio Infocomm, for example, is collaborating with US-based AirWire Technologies to launch its first connected car device for Indian users.

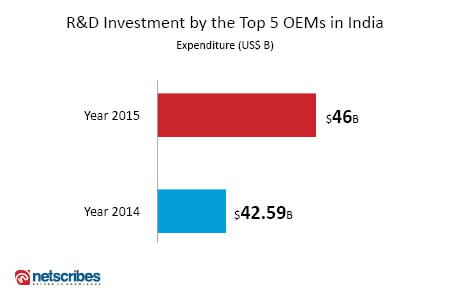

Another path-breaking update in the industry comes from Mahindra & Mahindra Ltd. The company’s Mahindra DiGiSENSE technology solution connects the entire gamut of Mahindra vehicles to the cloud – from tractors and trucks to construction equipment, adding a whole new dimension to the experience of vehicle ownership. IoT is transforming vehicles into intelligent connected platforms that provide safety, security, infotainment, and advanced vehicle management. In the year 2015, we saw the top five OEMs in India investing nearly USD 46 billion on R&D with eight percent increase in spends, year-on-year. Automated cars aside, the use of shared electric vehicles is also witnessing a steady growth in India.

On-demand business models, such as Ola, offer mobility at around a sixth of the cost of owning a vehicle outright and can be hailed and paid for electronically. Furthermore, various services offered by Ola, Uber and other online application-based cab aggregators, such as location sharing, and maps accessibility are updated in real-time, thereby allowing cab drivers to signal their position to respective clients. Hence, partnerships between shared electric vehicle manufacturers and the online application based cab aggregators could be a viable opportunity. In addition, the adoption of electric vehicles will result in a drastic decline of oil import dependency on the country.

The connected vehicle market potential in India

The concept of shared electric and connected vehicles could take up to 15 years to become mainstream in India. Meanwhile, India must enhance its manufacturing expertise to a global size and scale, develop electric vehicle (EV) componentry and improve its renewable energy capability in tandem with this goal.

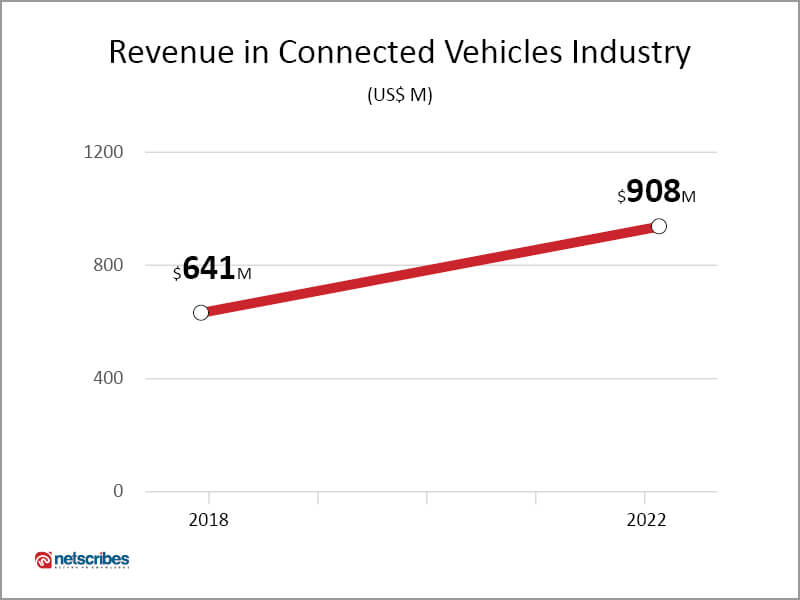

According to Statista, revenue of India’s connected vehicles market amounts to US$1,048m in 2018. These numbers are expected to see an annual growth rate (CAGR 2018-2022) of 8.4 percent resulting in a market volume of US $1,449m by 2022. Currently, the connected vehicles penetration rate is at 1.2 percent in 2018 and expected to hit 3.0 percent in 2022.

According to a report by Telematics Wire, by 2030, profits available to traditional automakers and suppliers may fall from 70 percent to less than 50 percent of the industry total globally, which will also affect the Indian automakers. The balance may be captured by new entrants, including suppliers of new technology, mobility services, or digital services.

While organizations are innovating and incorporating cutting-edge solutions for automotive giants, progress is being made in tow with some of India’s brightest minds in IT. With human resources being enticingly affordable and ample in India, these technology-invested companies are keen to set up R&D branches locally. Currently, the future for connected vehicles in India seems relatively vague given its cultural, socio-economic and political circumstances. Before connected vehicles become mainstream, there are certain factors that need to be regulated, such as road safety, parking and driving ethics, automotive laws and so on.

It is imperative for India to take bigger strides in embracing emerging technologies if it wants a piece of this revolutionary phase shift in the automotive industry. The focus should be on innovating the driver’s experience and creating frictionless access to the car’s varied features and seamless interfaces. Ultimately, though connectivity is just a part of the solution, building a suitable ecosystem to see this technology in play can eventually reduce car crashes and save lives.

Looking for more valuable market insights or detailed reports on connected vehicles? Or even any specific niche? Have something you want us to dig into? Contact us!