In 2017, the world experienced some of the worst cases of cybersecurity breaches. From credit agency Equifax’s data breach affecting over 143 million consumers to the tyranny of the WannaCry ransomware program that crippled the National Health Service hospitals in the United Kingdom, among many others. However, the most alarming of these were to the national defense such as the targeted attack by alleged Russian hackers on the US Army and NATO in October and the spyware campaign against Indian and Pakistani government security and military organizations.

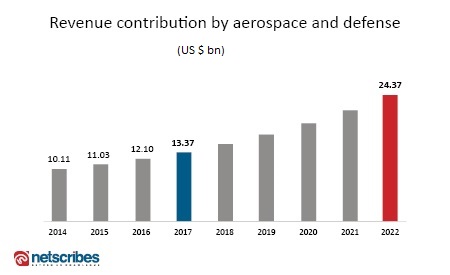

As cyber-attacks have become increasingly sophisticated, with allegations of one nation targeting another for geopolitical gain, the rate of cybersecurity investment in the aerospace and defense market has also been on an upswing. During these paranoid times, governments and organizations are investing more in the cybersecurity of defense and aerospace products and services than they have ever before. According to Netscribes research, the projected revenue contribution of the global defense and aerospace segment is expected to reach USD 24.37 billion by 2022. The overall cybersecurity market size is also expected to experience a strong growth during the same period and reach USD 125 billion by 2025.

Trends in the defense and aerospace cybersecurity market

Interestingly, the Asia-Pacific region is projected to experience the highest demand for cybersecurity products and services over the 2007-2022 period. This isn’t surprising since we have observed defense spending increases being announced from nations like Japan, India, Saudi Arabia, South Korea, and the United Arab Emirates. As these countries continue to modernize their militaries and defense capabilities with new technologies, the threat of cyber-attack only grows greater.

The significant tension between the need for technology advancements and simultaneously preventing these technologies from cyber-attacks is a key driver of investment in the cybersecurity sector. This is even more important in the aerospace sector where nations are moving towards the autonomy of spaceflight and investing billions in developing aviation technologies. The threats are more than simply financial for the defense and aerospace segment and can impact the lives of potentially millions of people.

Under such a scenario, various Ministries of Defense, in many nations, are looking to new technologies such as blockchain to fortify their security measures. Lockheed Martin, as one of the primary weapons suppliers of the world, has partnered with Guardtime Federal, in order to integrate blockchain technology into their existing data systems. Their goal is focused on taking steps to prevent the manipulation of their advanced weapons technology and related information.

Related reading: Financial services to contribute USD 125 billion to cybersecurity revenues by 2025

What’s driving growth in the defense and aerospace cybersecurity market?

As the dual trends of emerging technology and national defense continue to advance, we see new and unregulated threats come into view, further driving growth in the defense and aerospace segment. The two major technologies that are at the forefront of this change are:

- Artificial Intelligence: By creating autonomous drones, vehicles, and robotics for defense and war, the potential to save lives has increased, but so has the threat of these technologies being hacked. So while this integration can allow machines to take on complex tasks that require human intelligence, such as decision making and visual perception, they also demand significant investment in cybersecurity.

- The Internet of Things (IoT): One of the key methods of improving tactical advantage in the battlefield has always been to gather more data. With IoT enabled devices, the scope of data gathering is seeing never before reached heights, as defense agencies are able to interconnect aircrafts, ground vehicles, ships, weapons systems, and personnel with each other to share data in real-time. But the prevalence of data gathering devices also means there are more points of vulnerability in the digital landscape. These mesh networks have already faced immense threats in the form of Distributed Denial of Service attacks which have targeted IoT devices to spread malware and infections. These threats have spurred investment by defense agencies to find ways of securing and preventing such attacks in the future.

Challenges and the road ahead

The defense and aerospace market segments are extremely technology-forward and highly digital in their operations. The degree of complexity integrated into their design, products, function, and execution makes them highly vulnerable targets for cyber-attacks.

As the aviation and aerospace segments further expand, they are taking advantage of all the new technologies that can help them optimize their performance. However, this comes with a larger systemic risk which requires proactive cybersecurity management that can address these challenges and mitigate risk.

One of the major challenges that these segments face going forward is their complex and highly distributed supply chain. The large interdependence between supply chain elements poses a challenge as composite systems are accessible and operated by multiple organizations. This places these highly sensitive systems in an extremely vulnerable position, ripe for cyber-attacks and is perhaps the weakest component of their supply chain.

As the defense and aerospace industries continue on their upward growth trajectories, a significant part of their strategy will seek to address these challenges, which will drive investment in cybersecurity products and services. And given the convergence of emerging technologies and low-risk tolerance, many innovative and leading product and service providers in cybersecurity are likely to experience growth in their business as well.

For comprehensive market and competitive intelligence, highlighting the opportunities, whitespaces, and implications of the trends in the cybersecurity and defense and aerospace markets, contact info@test.netscribes.com.