How happy are customers with your products and services? This simple question can unlock a world of insights to improve your business.

It is no secret that customer satisfaction is directly proportional to business performance. High customer satisfaction guarantees a lower churn rate, loyal customers, and a significant competitive advantage. It is also more cost-effective to retain existing customers than to acquire new ones. So it goes without saying that organizations need to keep tabs on their customers’ satisfaction levels to increase their profitability.

Determining customer satisfaction can reveal growth opportunities and improvement areas. What market research techniques can you employ to best assess customer satisfaction? Our in-house consumer research team has compiled a list of seven top methods that firms can leverage to evaluate their CSAT.

1. Customer satisfaction surveys

Customer satisfaction surveys are crucial to research and understanding your customer’s preferences and driving a more customer-centric organization. They offer direct insight into your customer feedback. But the survey experience is just as important. Often CSAT surveys are disregarded and face low response rates. To overcome this and increase respondent engagement, it is important to consider the timing of the survey, what format will work best, and how relevant the questions are in the questionnaire. Here are seven variations to consider:

a. In-app surveys

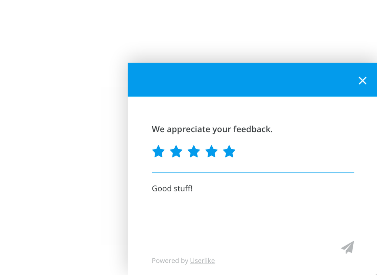

Surveys that are placed within the app or a website are made available to customers while they are utilizing your service. This increases the chances of a prompt response and a high response rate. To avoid taking away from the user experience, in-app polls must be seamlessly integrated into the user interface.

For instance, using a pictogram (stars, emojis) rating system or adding a subtle comment bar to the top of your interface can ensure engagement without disrupting the app experience. The key is to keep the surveys brief and to the point.

b. Post-service customer surveys

These surveys get in touch with the customer right after a service engagement and can be conducted over the phone, live chat, or by email. The goal of the call or message should go beyond merely obtaining feedback. Let the customer know they are heard and how this feedback service benefits them as well.

Ask for feedback as soon as a problem has been resolved or when introducing a new feature. Unlike in-app surveys, post-service surveys may take a little longer, but the key is to avoid inconveniencing the customer.

c. Email surveys

Email is the best option to make more general inquiries about the complete customer experience. By incorporating tools like Google Forms, you can explore more detailed, in-depth questions targeted to specific customer segments to learn more about their preferences. Although these surveys record the lowest response rates, they offer the opportunity for customers to provide detailed and comprehensive answers that provide you with useful feedback. Incorporating this research can increase customer satisfaction across a larger range of factors.

d. Volunteered feedback

Offering a way for customers to express their opinions voluntarily is just as vital as explicitly asking for their comments in a survey. Dedicating a comment section or email address for anonymous reviews, grievances, or even positive feedback can prove immensely helpful.

e. Individual interviews

Engaging in interviews with individual customers over the phone or in person, either by following a scripted questionnaire or in a free-form conversation, allows for honest, in-depth feedback.

f. Feedback cards

This is a low-cost, easy way to get anonymous feedback from existing customers. Feedback cards are left on counters in-store or given out to customers.

g. Focus group discussions

Moderator-led focus groups of 5-8 people discussing a chosen subject are also a good way to discover people’s perceptions related to certain products and services. Group discussion facilitates increased participation and can generate constructive feedback.

Related reading: Planning a CSAT study? Here’s how you can derive better insights

2. Customer satisfaction (CSAT) score

This is the most standard consumer loyalty metric, requesting your customer fulfillment rate with your business, item, or administration. Your CSAT score is then the average rating of your client’s reactions.

The scale commonly runs between 1 – 3, 1 – 5, or 1 – 10. A wider reach isn’t necessarily better, owing to social contrasts in how individuals rate their satisfaction. Rating scales that are straightforward and less complicated capture customer satisfaction better. In fact, the US government uses a straightforward emoticon-based CSAT rating system for its criticism and a 5-star quality rating system for healthcare services including nursing homes.

The appeal of the CSAT metric comes from its unequivocal quality. It is aimed at customer feeling, which depends upon mood.

3. Net Promoter Score (NPS)

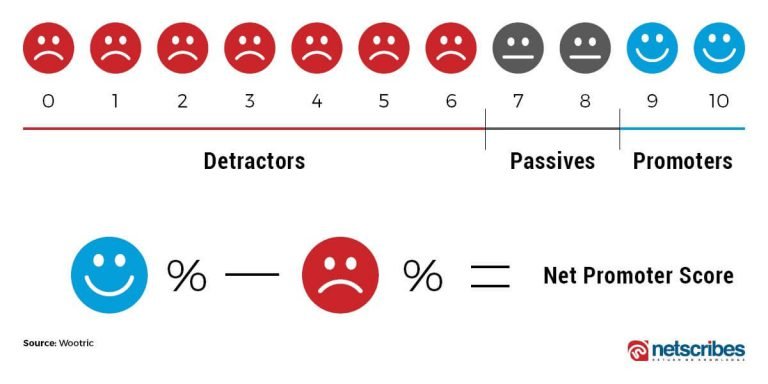

A Net Promoter Score (NPS) Survey is a simple and effective research metric for determining customer satisfaction.

NPS compares the likelihood of a customer recommending you to others. It is a well-known method for estimating client reliability by asking, “How likely are they to recommend you on a scale of 1-10?”.

NPS scores are easy to calculate. Take the percentage of respondents who fall within the ‘promoter’ category (10 – 9) and subtract the percentage of ‘detractors’ (0 – 6).

4. Customer churn and retention rate

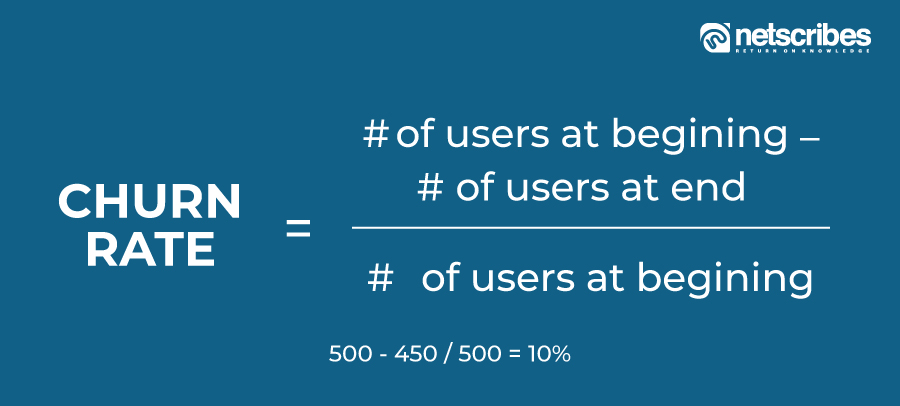

Customer churn rate is a measurement of customers you lose during a period of time. A churn rate higher than 5% is cause for concern.

Customer retention is impacted by how many new customers are acquired, and how many existing customers churn. Before formulating a retention strategy, identifying your current customer retention rate is very important. This has an easy, standard formula.

First, define a period for measurement, e.g., quarterly or yearly. Then, apply this formula:

[(Number of customers at the end of the period (CE)– Number of customers acquired during the period) (CN)/ Number of customers at the start of the period (CS)] x 100

or

((CE-CN) /CS)) x 100

5. SERVQUAL

SERVQUAL is a multi-dimensional research technique that assesses the five individual components of customer satisfaction and service quality. This metric helps you distinguish between the level of service that your company provides and the level that customers expect. The SERVQUAL framework gathers information by requesting a scaled reaction on five key RATER characteristics:

- Reliability

- Assurance

- Tangibles

- Empathy

- Responsiveness

6. Customer Effort Score (CES)

CES, derived from a CSAT survey, measures a product’s ease of use, an important aspect of the customer experience. It measures how quickly a customer’s issues are resolved. CES shifts the focus of customer satisfaction research from merely delighting the customer to hands-on problem resolution. Customer satisfaction begins by making problem resolution a key focus: simplifying and speeding up the process for a better customer experience.

As a best practice, measure the CES immediately after your customer has interacted with your product or service. Hence, instead of asking “How satisfied are you with this service?”; questions like “How easy was it to get in contact/make a purchase/have your issue resolved?” are likely to be a better CES indicator.

7. Social media sentiment analysis

With customers actively turning to social media for their purchase decisions, social platforms like Twitter, Facebook, Instagram, LinkedIn, Reddit, and Quora among many others are becoming an important outlet for consumers to engage in discussions regarding their experiences.

Social listening can be leveraged to gauge consumer satisfaction levels. This is done by analyzing consumer sentiment (positive, negative, or neutral), based on consumer feedback on social media platforms. By employing natural language processing (NLP) and text analytics, sentiment analysis can assist businesses in drawing insights from rapidly changing consumer behavior. Additionally, tools like Google Alerts and SocialMention can come in handy to track the vast amount of data on such platforms.

By leveraging these techniques, you can determine customer satisfaction. But how do you leverage these insights to improve customer satisfaction? Our consumer research team shares a few tricks of the trade:

Fast-tracking consumer feedback

Crisis situations like the COVID-19 pandemic required quick turnaround times to meet the demands of the new reality. Today, technology-enabled consumer insights tools allow fast feedback. The use of digital market research platforms enables organizations to gather consumer feedback from large sample groups quickly and cost-effectively. With online data collection methods, self-serve systems, and other automated tools, fieldwork and data processing are now streamlined to a few hours of work over the earlier several week-long endeavors. Timely feedback helps in evidence-based decision-making. Tracking what is happening in the present, is key to driving quick decision-making.

Fast-tracking feedback will further facilitate quick turnaround times to address customer concerns and implement the desired changes.

Leveraging technology-driven research methods

Digital market research spending has surpassed the traditional methods since 2018. While tech-enabled market research (like online surveys, etc.) plays an important, cost-effective role in speeding up conventional research methods, tech-driven market research enables to overcome the gap between claimed statements and implemented actions.

Tech-driven market research combines data science techniques with new data sources. This opens opportunities to not only track real-time consumer behavioral data but also for historical data analyzed by trained data science models to be capitalized to predict emerging trends in consumer purchasing behavior.

Social listening in real-time is a popular example of analyzing consumer behavior from unstructured data. Even before the pandemic, PepsiCo integrated an in-house tech-driven analytics capability with cutting-edge market research tools called Ada into their core business processes to increase customer collaboration and knowledge-sharing. Newer technologies like AI and NLP can analyze in-the-moment consumer behavior to gauge satisfaction and better serve customer needs.

Today, you are not just competing with the competition you are also competing with your customer’s last best experience. With a focus on real-time analytics, firms are relying on data intelligence in their customer interactions to build stronger human connections to their brands. Continuously assessing your customer’s satisfaction is important to building a lasting relationship with your customers.

Need help with determining customer satisfaction for your products and services? We’re here to help! Find out more about our consumer research solutions.