Globally, insurance firms are navigating volatile markets of economic uncertainty. As the pandemic-induced financial crisis persists, the future will require industry participants to juggle with dynamic investment, business, and regulatory conditions. What’s being observed is that insurers and brokers who swiftly pivoted to digital channels enabling seamless operations experience improved growth across insurance markets.

Outlook for 2021

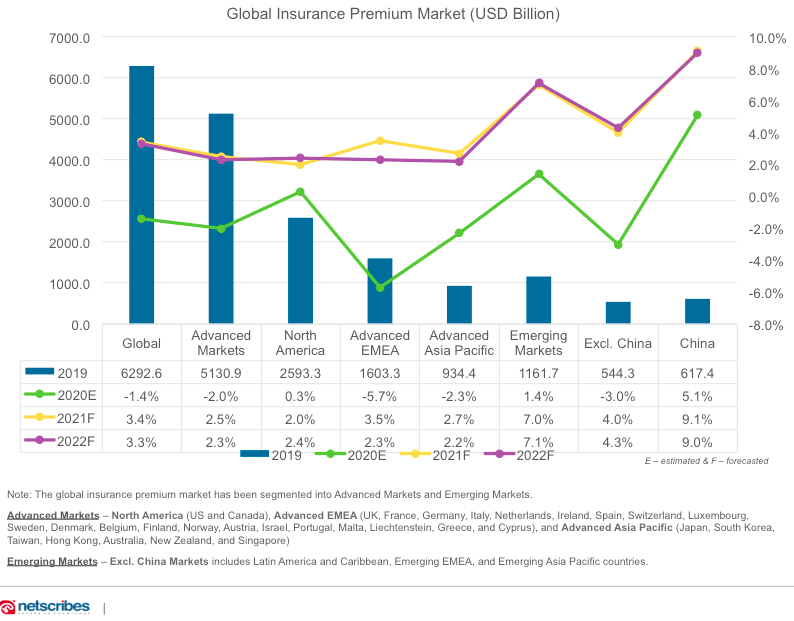

According to Swiss RE, the global insurance premium market, in 2019, reached USD 6.3 trillion with an estimated contraction of -1.4% in 2020 and forecasted recovery growth rate of over 3% between 2021 and 2022. Global non-life insurance premium growth is expected to see a 3.6% annual improvement over the next two years, with the core driving factor in the non-life insurance market stated to be rate hardening in commercial insurance (i.e. where the market is less competitive and underwriters adhere to stricter standards). Global life premium insurance growth is expected to rebound to 3%; with increased risk awareness owing to COVID-19 and global economic recovery set to accelerate the demand for life insurance products.

The pace of the global economic recovery will shape the outlook for the insurance market across regions. Advanced Asia Pacific regions and the US are expected to outperform Advanced EMEA countries in the next two years, with an expected 6% growth across 8 of the largest markets in commercial property and liability lines. China is set to be the world’s fastest growing country given quicker adoption of digital distribution channels across both non-life insurance and life insurance markets. While life products are predicted to grow at 8.5%, in non-life, double-digit growth is expected in 2021 and 2022. In other emerging markets, growth is expected to be weaker for non-life insurance products, with an estimated growth rate of 6.9% for life insurance products in the next two years.

Here are the key strategic and operational priorities for 2021:

Automated claim management

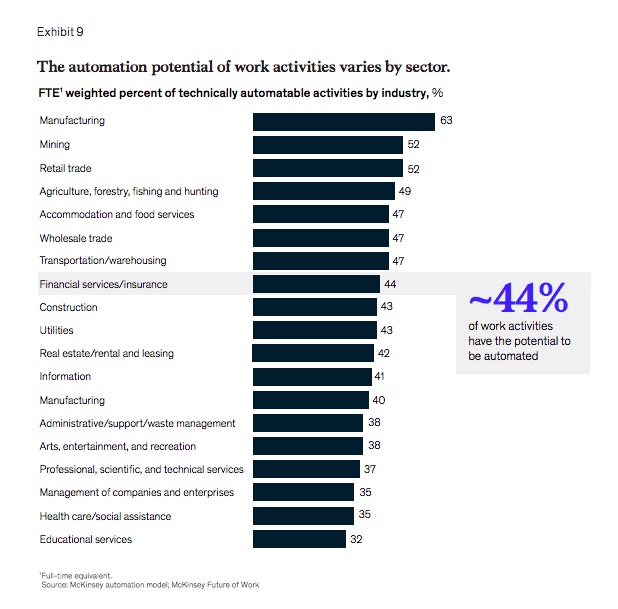

Implementing the use of automation and digital processes for business optimization is set to have a strong ROI. ITONICS survey suggests that digitized claim processes and the use of robotics have shown to deliver productivity enhancement and lower costs by as much as 20-40%. According to McKinsey, using automation and RPA implementation can reduce the cost of claims by 30%. Automated claim management further enhances customer satisfaction with its improved service and faster processing times. With convenient and seamless user experiences now a norm, FinTechs and InsurTechs now go beyond just a few chatbots, offering personalization in services as well as omni-channel support.

Product personalization

LivePerson survey findings indicate growing preferences for personalized AI messaging and user services. 71% of the consumers surveyed report their preference of an insurance company that provides personalized services, stating improvement in trust factor if company associates are readily available via chat for solving user problems. Here, AI powered chatting tools will prove extremely beneficial, with 75% of consumers further stating their desire to directly converse and consult with an insurance professional before making a purchase. Instances of a personalized product include the promotion of usage-based insurance via real-time monitoring that most (nearly 9 out of 10) auto-insurers offer today.

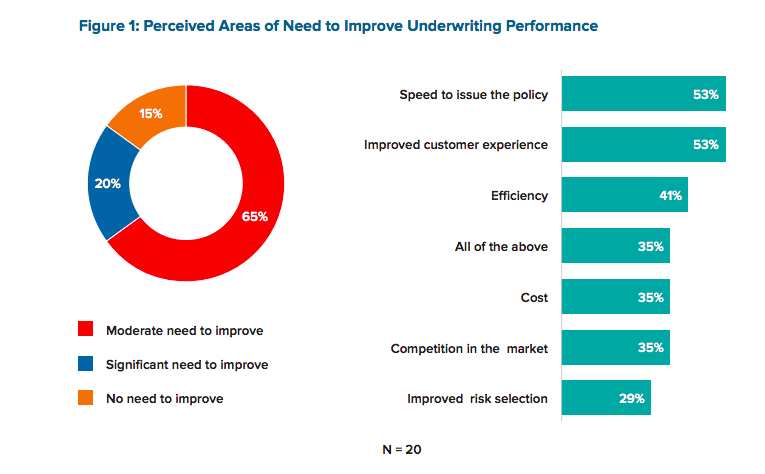

Underwriting process enhancement

According to RGA’s survey, 85% respondents indicate the urgent need to improve underwriting performance. Of this, 53% stated enhancements in speed of policy and improvement of customer experience as the key focus areas. Insurance premiums underwritten by AI are estimated to cross 20 billion USD by 2024 – seeing an over 1,500% growth in the next 5 years with implementation of AI-driven tools. With at least 30-40% of an underwriter’s time spent on manual administrative tasks, the opportunity for digitization stands ripe. By 2030, a McKinsey survey estimates that manual pricing and underwriting would entirely cease to exist for small and personal commercial products across life and P&C insurance.

Modernization of Distribution Channels

Prior to COVID-19, approximately 70% of the ongoing insurer-client engagement was conducted in person across the US. Pandemic restrictions accelerated remote communications with shifts in volume towards digital. To address the challenges of establishing new modes of customer relationships, insurance firms will have to rethink distribution models across customers, enablers like investment agencies and their sales force. According to BlackRock’s research survey, 69% of respondents plan to change their distribution landscape to accelerate growth within the market, with 71% planning to strengthen digital distribution to adapt to the post-COVID environment.

Insurance industry’s transition over the next decade:

The next 10 years will see the insurance industry transitioning from traditional to more customer-centric products. Pre-pandemic, the insurance industry worked along a set of pre-existing formulas where the data provided by individuals was used to assess risk and offer standard products. Individuals are presented with a set of predefined policies – pre-existing in the insurance sector across firms, with set pricing, standard services and SLAs.

In the post COVID-19 era, with personalized services, these products are offered based on information collected from external sources and devices. The next decade is set to see the use of algorithms for financial planning along with human feedback and advice, with advanced algorithms that match the customer to their most suited channel and advisor.

Digital advancements working to provide seamless consumer experiences will further provide customized pricing and smaller risk pools based on customer requirements. An integrated engagement platform will allow data, insights and transactions across multiple industries to be used among entities. This will lead to an increased adoption of usage-based insurance products tailored to individual needs.

The introduction of integrated insurance solutions will eliminate the need for traditional products altogether. The implementation of automation in underwriting processes will not only reduce manual efforts, but also lower underwriting overheads. Insurance agents will begin to use AI-based assistants on a routine basis to help optimize tasks, and bots that recommend the best-fit deals for customers. Ten years later, post 2030, the insurance industry would have entirely transitioned to modernized, customer-centric processes. Prescriptive algorithms can be forecasted to be used by agents or digital channels to actively influence customers purchases. The implementation of RPA and conversational AI will reduce a majority of manual efforts undertaken, thereby actively optimizing cost and resolution time.

How digitalization aims to transform the insurance value chain:

Today, we live in a digital world, where technology is embedded in our daily lives and work. The insurance industry is also rapidly adapting to these seamless virtual operations. With the adoption of AI, RPA, cloud computing, Internet of Things, and blockchain, digitalization is set to transform the insurance value chain.

AI and RPA

Currently, about 68% insurance companies are either in the process of testing or adopting AI. By 2025, the insurance industry has the potential to automate 25% of its processes (especially manual processes like claim processing, underwriting, customer service, and policy administration) using AI and machine learning.

Certain use cases for RPA (Robotic Process Automation) include claim settlement, fraud detection, real-time data analytics, customer experience, and product personalization.

On combining RPA with AI tools, bots can help collect data from internal and external sites, extract information, analyze customer history and further identify and verify fraudulent claims.

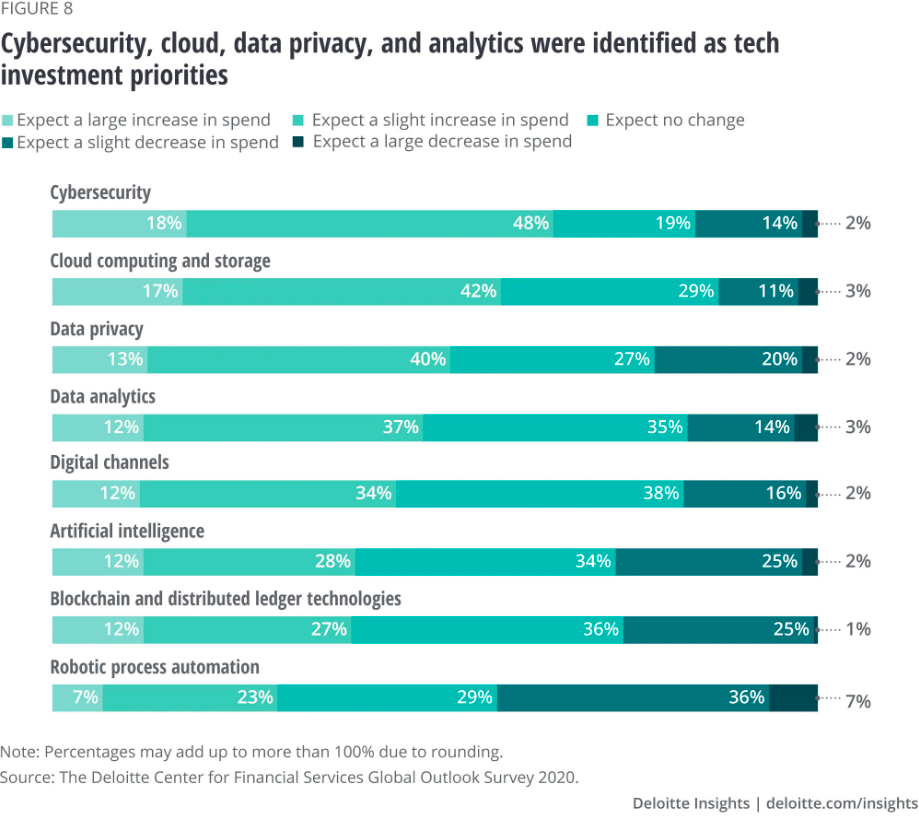

Cloud Computing

Insurance firms concede the need to adopt and implement advanced digital technologies to their processes at a faster rate. ISG Survey indicates 51.3% insurance companies planning to invest in cloud transformation. Further, 59% CIOs aim to increase spending on cloud computing and storage technology. Use cases of cloud computing in insurance include cloud storage, collaboration, backup and disaster recovery, scalability and flexibility.

Internet of Things

With the internet of things, insurance firms can use automation to read and analyze customer data to provide further personalized customer experiences. Close to 78% of US-based smart home device owners surveyed by LexisNexis are willing to share their data with insurance providers. According to IDC’s forecast, by 2025 there is set to be 55.7 B-connected devices worldwide, with 75% connected to an IoT platform – with devices including sensors, appliances, wearables, clothing and more. Its applications range from telematics and wearable fitness devices, to smart homes and connected buildings.

Blockchain

With the adoption of blockchain technologies across industries growing at a rapid rate, Accenture’s forecasts indicate that the use of blockchain in the insurance industry globally could grow to 1.38 billion USD by 2023 (up from 64.5 million USD in 2018). The focus largely remains on using private and secure blockchain, controlled by a central entity, unlike the commonly used public and permissionless blockchain networks used in general. Deloitte’s 2020 survey suggests that 39% of CIOs will increase their investments in blockchain technology. This will be especially beneficial in fraud prevention, anti-money laundering, smart contract, and data decentralization.

Cybersecurity

An industry like insurance is plagued by threats of cyberattacks, standing especially at risk with the sensitive and confidential data involved. Accenture’s research report states that cyberattacks on insurance providers have reached an average of 519 attacks in two years compared to 240 in 2018, indicating a volatile climate for insurers. 44% insurers had exposed over 500,000 customer records. In such cases, in view of the increasingly volatile tech driven online environment, it becomes imperative to invest in cybersecurity technology that aids in data breach prevention, regulatory compliance adherence and detection of cyber threats.

As insurers and insurtech firms adapt to the new economy and constantly strive to innovate, the long- term impact of digital shifts must be carefully assessed to weather the toughest crisis situations in 2021 and beyond.

With rising challenges of new market entrants and changing consumer expectations in the insurance industry, Netscribes provides the latest data and insights that helps firms stay ahead through competitive intelligence and adequate market research. To know more about how we can help cater to your needs, contact us.