With rising concerns surrounding climate change, EV (Electric Vehicle) mobility has presented itself as an environmentally viable alternative to ICE-driven (Internal Combustion Engine) vehicle formats. Amid the growing popularity of electric vehicles, 31.1 million electric cars (with ranges that will top 200 miles) are expected to hit the road by 2030. While the electrification of car fleets can help reduce the total cost of ownership and CO2 emissions, will there be a strong EV charging infrastructure to support electric vehicle rollout in the near future?

To illustrate, by 2030, in Europe alone over 2.8 million EV charging stations will be required to support the significant rise in EV purchases. This means that regulatory initiatives in regional markets will be obligated to support the installation of robust EV charging infrastructure to encourage the adoption of e-mobility.

As the global automotive industry explores sustainable commute alternatives, automakers must figure out how to overcome immediate infrastructure gaps. Read on to uncover the challenges companies face in establishing EV charging infrastructure and the emerging opportunities that could act as growth catalysts.

Unpacking the challenges

1. Need for a highly localized EV charging infrastructure

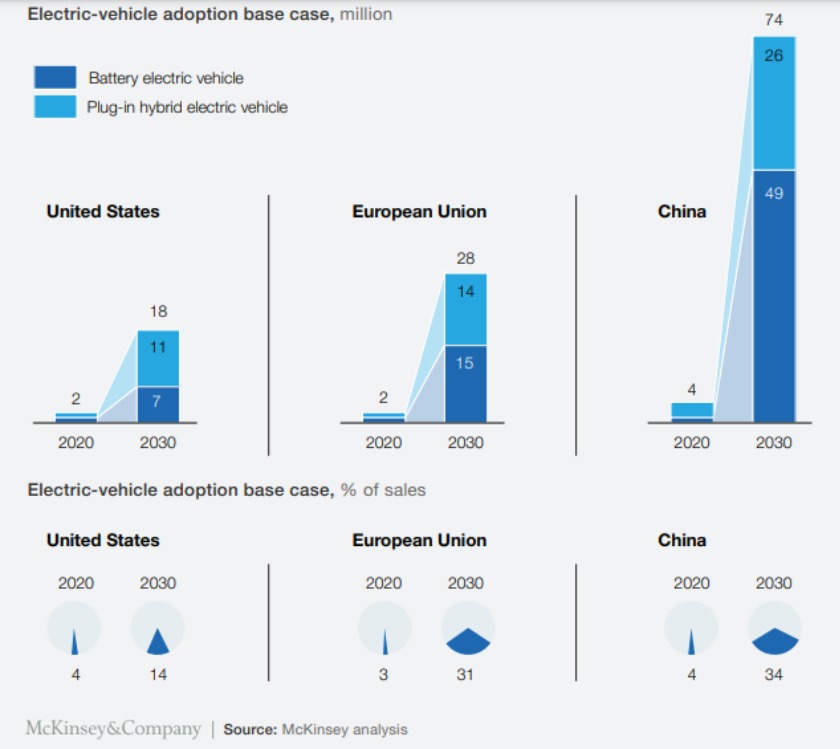

A McKinsey study on EV adoption suggested that 120 million EVs could hit the roads in China, Europe, and the United States by the end of this decade. The level of adoption of electric vehicles will differ across regions. This will affect the structural considerations of charging-station demands from a localized perspective.

For an EV owner living in a high-rise apartment in New Delhi, India, shared-parking spaces will govern charging demands. However, an EV owner living in a private residence or low-rise home in California, USA can utilize their parking garage to install EV charging units. Such differing EV charging infrastructure requires companies to track, analyze and strategize to keep pace with local demands.

2. Different EV batteries and charging point technology

An EV’s battery technology impacts the frequency of charging sessions required by that vehicle. While some electric cars offer high ranges, others can cover moderate distances with one charging session. This dictates the number of public charging stations required in a particular region.

On the other hand, the charging time for EVs depends on the capacity of charging points. Regular AC charging point technology can provide a Level 1 (equivalent to a US household outlet) or Level 2 (240 volts) charging capacity. However, it needs more time when compared to a fast Level 3 DC charging point technology.

This means that AC charging points are suitable for homes and workplaces, while DC charging technology can be used on highways. With EV mile ranges increasing rapidly in the coming years, high-power fast-charging infrastructure technologies are slated to emerge in public spaces.

3. Increase in energy demands with exploding EV sales

As EV sales continue to surge, the total charging-energy demand in China, Europe, and the United States will increase from roughly 20 billion kilowatt-hours in 2020 to about 280 billion kilowatt-hours in 2030. Factors including the number of chargers installed and the amount of energy provided by these charging points will affect an EV owner’s choice of charging location.

EV owners who do not have chargers installed at home or workplace will have to charge in public. EV owners with high battery range may need to visit fast-charge stations. The challenge for companies will be to establish public charging infrastructure across locations to help such customers.

4. High costs of upgrading power grid to absorb EV charging load

Electrification of transport creates a high power demand. The rise in adoption of EVs will require a significant increase in grid capacity. The upgrade can handle the surge in charging load in certain locations at a point in time. To meet these demands, utilities will need to invest in upgrading the transmission and distribution systems.

By 2030, the high investments in grid upgrades may range from USD 1700 to USD 5800 per EV according to BCG. The challenge for utilities will be to ensure that the upgrades do not excessively pressure the consumer electric rates.

Opportunities to seize

The industry is currently focusing on pushing EV sales and producing attractive EV models. As the aforementioned challenges take the front seat, industry stakeholders do well to focus on customer experience following an EV purchase.

This includes enhancing the EV charging infrastructure to further support the adoption of sustainable mobility. Here are the emerging opportunities for policymakers, OEMs, and suppliers to fill the charging infrastructure gap.

1. An adequate rollout of public EV charging stations

Increasing the fleet of EVs and charging infrastructure will be key to improving air quality in cities. This will also enhance energy security by reducing dependence on imported crude and help fight climate change. Installation of charging stations at logistically viable locations can help achieve these EV ambitions. Public entities can invest in and build EV charging infrastructure to propel increased EV adoption.

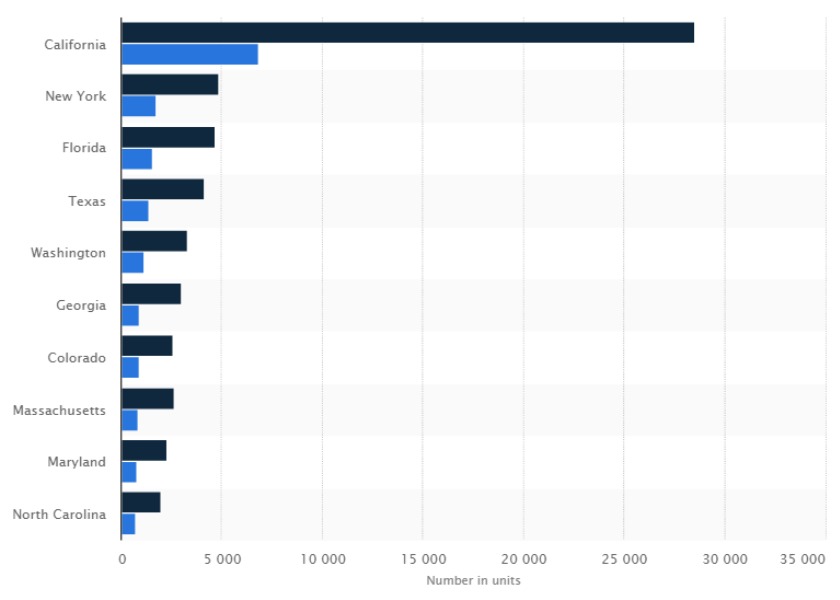

In the United States, the overall number of public charging outlets for electric vehicles exceeded 78,500 in March last year.

Moreover, an infrastructure that accelerates simultaneous, high-powered charging at public charging stations will be imperative. Tesla operates over 23,000 Superchargers worldwide with an average of 9 chargers per station. These stations can charge up to 150 kW of power per car distributed between two cars.

2. Adoption of newer EV charging technologies

It is clear that the adoption of EVs largely depends on the availability of better-charging infrastructure. Hence, companies that leverage innovation hold the onus of providing the best charging solutions to consumers.

Major automakers and technology providers will consider betting on newer methods of EV charging to increase adoption and lower the cost of EVs. BMW Group, Daimler AG, Ford Motor, Volkswagen Group, Audi, and Porsche have jointly created an ultra-fast charging network (350kW) in Europe.

Volkswagen’s V-Charge technology can automate processes like detecting a parking spot and charging an EV through a wide network of sensory devices. At the same time, wireless charging technologies are also being licensed as a built-in feature to car manufacturers, such as Nissan and Toyota.

3. Using renewable energy for sustainable charging infrastructure

Several EV stakeholders are rolling out pilot programs that allow residential and commercial customers to use renewable energy for their charging needs.

Austin Energy has developed a Plug-in EVerywhere Network that allows customers to source 100% of their charging electricity from wind. Then there are managed-charging programs that allow EV owners and utilities to align the timing of charging with clean energy availability and grid needs.

Companies like Amazon are now establishing goals to convert their vehicle fleets to EVs and power them with clean energy sources. They can explore an EV charging infrastructure that enables customers to align charging with clean energy sources, thus offering their customers better saving benefits.

4. Scaling EV charging infrastructure with a focus on interoperability

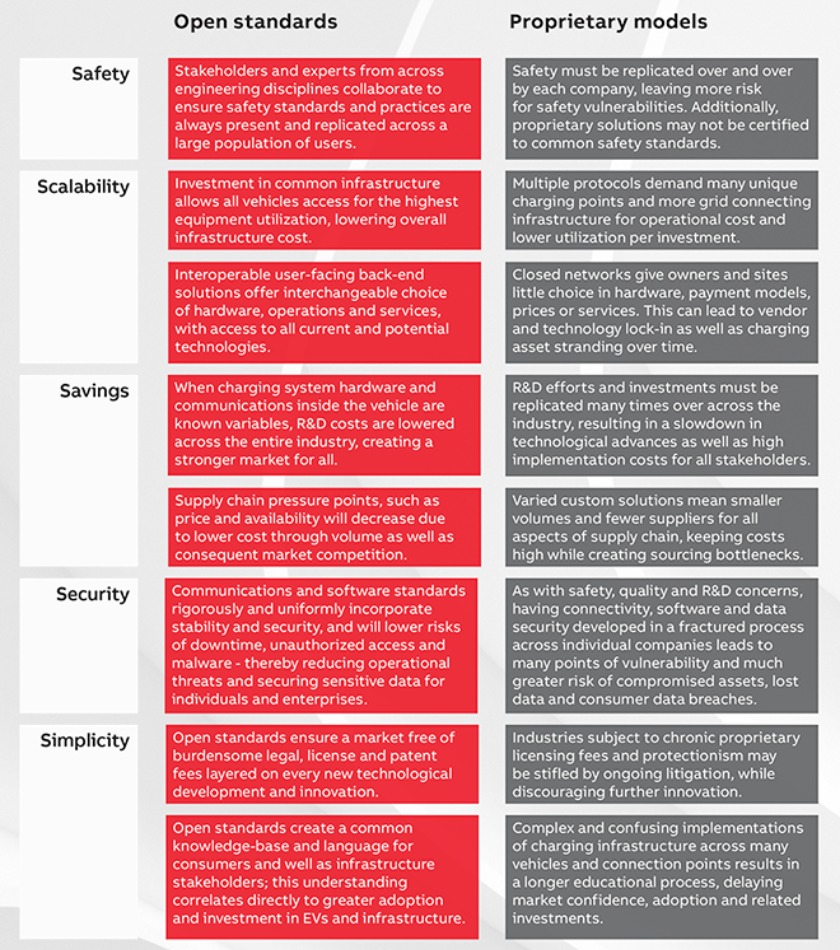

Interoperability is the open communication and exchange of data between and among devices and/or software systems. It can be a big boon to the EV charging infrastructure.

By ensuring communication between the vehicle, charging station hardware and connectivity software, network operator, energy management system, and power supply, interoperability as a strategy can provide safety, scalability, and saving benefits.

The open exchange of operational data between EV charging stations, network operators, and back-end payment systems is critical to public and private charging infrastructure. With the help of an interoperability strategy in place, charging station owners and operators can ensure that their charging assets serve drivers and vehicles well while providing valuable data and revenue back to them.

Moreover, as DC charging station developments gain speed, investors will look forward to the flexibility that comes with open networks. These systems are adequate for EV drivers who rely on them for comfortable and secure commutes to and from home every day.

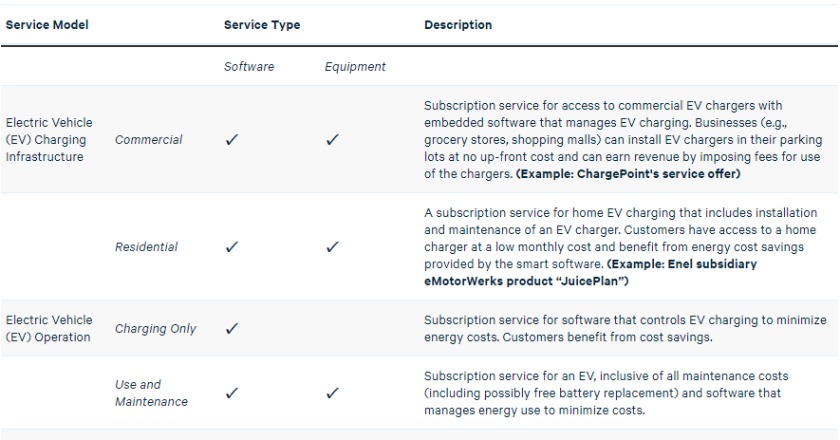

5. EaaS (Energy-as-a-service): an opportunity for utilities

Companies will increasingly focus on energy efficiency to lower their carbon footprint. To build and maintain sustainable generation assets, they are considering new business models, including subscriptions, energy savings performance contracts, and power purchase agreements through EaaS providers.

Energy-as-a-service (EaaS) companies can buy and install energy-efficient technology such as LEDs and solar arrays to electric vehicle charging stations for a monthly fee or at a fixed rate per unit of energy consumed. Furthermore, a home charging EaaS subscription service can give customers access to a home charger at an affordable monthly rate and a cost savings benefit provided by smart software.

The road ahead for EV charging infrastructure

Robust charging infrastructure is crucial for the mass adoption of EVs. The large-scale rollout of charging points that effectively address customer concerns about range, infrastructure availability, and EV attractiveness will drive sustainable mobility. Global investors along with automotive and energy industry participants are expected to harness the rising demand for the EV charging infrastructure stack by partnering with local suppliers.

Netscribes helps automotive industry practitioners identify new growth opportunities, understand the impact of emerging technologies, and drive innovation through market research solutions. To learn more about the latest developments in the electric vehicle technology space, contact us.