The pandemic has led to increased anxiety for many people across the globe. Social, political, and economic instability, combined with a prolonged period of physical distancing, have fueled a behavioral health crisis. According to a recent survey by Mental Health America, almost 100K Americans have reported anxiety or depression as a result of COVID-19 upheavals. In April 2020, a study found that 13.6% of US adults reported symptoms of serious psychological distress, versus 3.9% in 2018.

Google searches for “virtual mental health,” quickly spiked at the end of Q1 of 2020, as people searched for alternative options for in-person behavioral health services. According to a study by the University of Oxford and NIHR Oxford Health Biomedical Research Centre, nearly one in five COVID-19 patients are diagnosed with a psychiatric disorder such as anxiety, depression, or insomnia within three months of testing positive for the virus. So it comes as no surprise why digital behavioral health companies attracted funding of over USD 1.6B in 2020 – the highest it has received in any given year. We took a closer look at the deals to reveal the top companies and trends dominating this space.

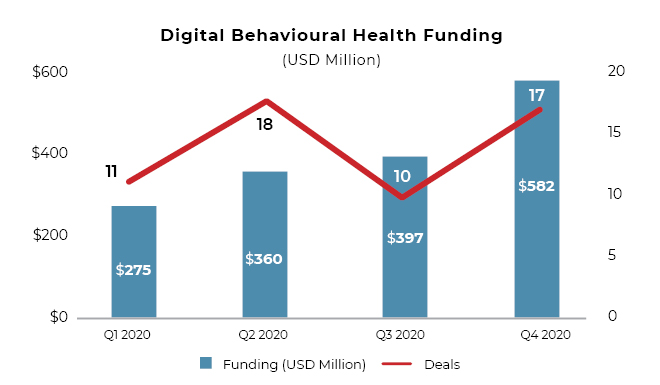

Quarterly funding growth of digital behavioral health firms

Funding for digital behavioral health companies was significantly higher in 2020 compared to the same period in the previous year. We have noted that Q4 of 2020 has seen a funding growth of 47% over its previous quarter. This steady rise in funding shows that startups in this sector continue to witness growth despite the challenges presented by COVID-19.

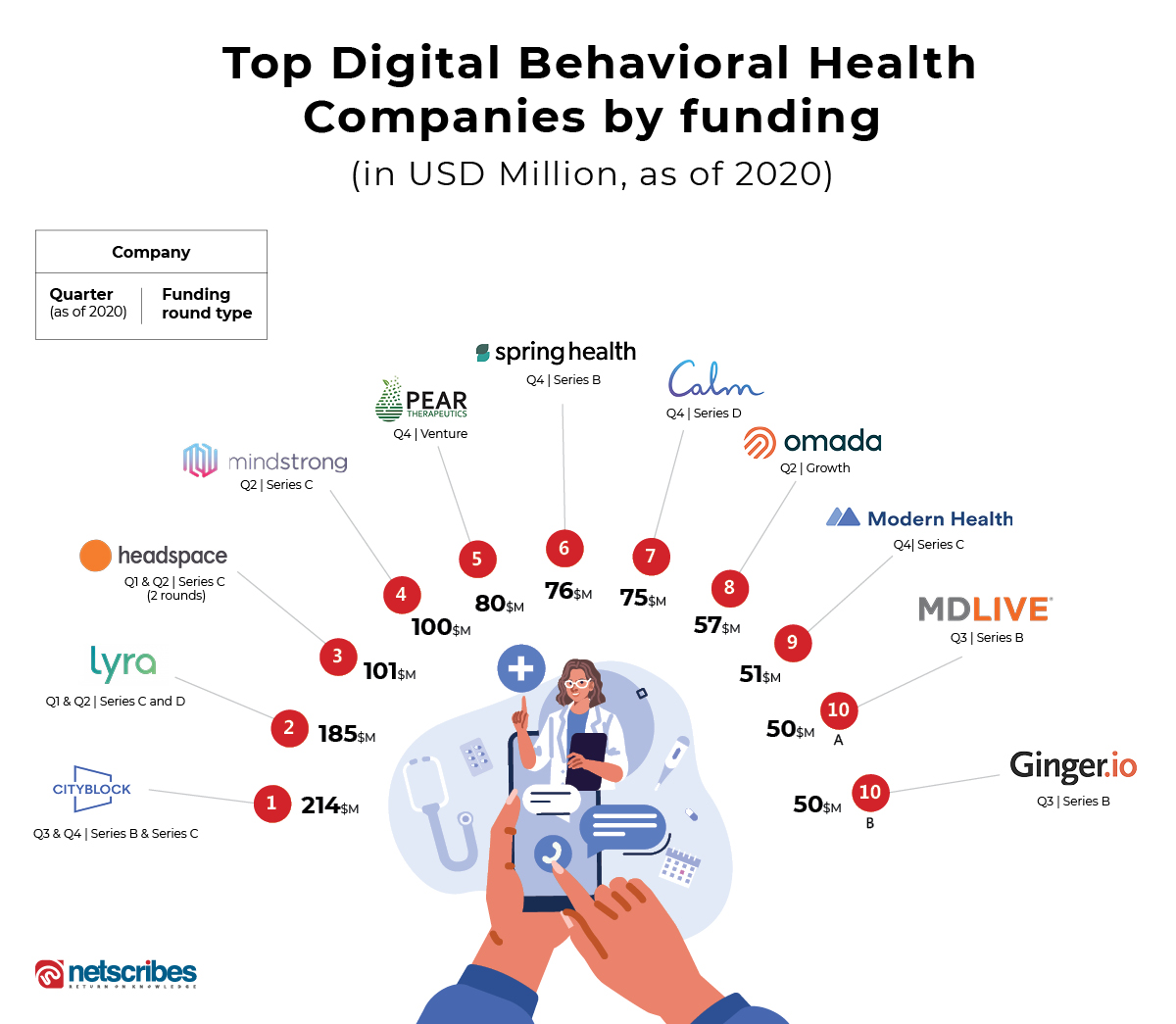

Now let’s take a look at the top ten digital behavioral health companies based on funding.

Five trends in the digital behavioral health industry

1. Employer-focused startups

Seven out of the ten top funded digital behavioral health startups are focused on employers. Lyra Health, Spring Health, Omada and Ginger.io, are some of the leading startups in this list. These companies have employer benefit programmes that are especially tailored to meet the needs of working professionals. These include behavioral coaching and offering advice for maintaining a proper work life balance. These programmes are not only used by individuals, but they also help work-places provide behavioral health treatment options for their employees.

Startups in this field provide their employers with behavioral health data and insights. They also include various activities and suggestions for lifestyle changes, as well as therapy. For instance, Ginger not only offers a behavioral health analytics platform that converts mobile data into health insights, but provides behavioral health coaching services, as well.

2. Telehealth platforms lead the pack

According to a survey by Amwell, telehealth adoption in psychiatry and therapy was 80% before the pandemic. This has increased to 96% in 2020 following the beginning of the pandemic. And 100% of those in psychiatry reported a willingness to use telehealth in 2020, post-COVID-19.

Out of all the digital behavioral health startups that received funding in 2020 as of 10 December, around 55% are telehealth platforms. Of these, platforms focused on teletherapy and psychiatric care, such as Mindstrong, MDLive and SonderMind, gained the most traction during the pandemic. These companies work on bridging the gap between patients and behavioral health specialists such as psychiatrists, psychologists, counsellors, etc. They provide therapy virtually, whether through chats, video-calls or voice calls.

3. Meditation and sleep-tracking platforms take the spotlight

By the end of July 2020, Ginger.io had seen a 20% increase in night-time conversations with behavioral health coaches, pointing to stress and anxiety-related sleep disruption.

According to a Teladoc study, Gen Z and Millennials continue to increasingly face anxiety issues. Out of all the mental health diagnoses included in the study, 58% patients have been shown having anxiety and adjustment anxiety disorders in 2020, compared to 53% in 2019.

Evidently, platforms which provide facilities for meditation and sleep-tracking have been particularly active. These apps help with stress management, depression and insomnia, among other mental disorders.

Calm, a meditation and anxiety management app, which achieved unicorn status in February 2019, has recently raised its valuation to USD 2B after receiving USD 75M in funding. It announced that its daily downloads have doubled in 2020, in comparison to the previous year, and users have listened to more than 1 billion minutes of their content this year, a 100% growth since 2019.

4. The intersection of behavioral health and chronic disease management

As per the North Country Health Consortium’s research, 68% of adults with a mental illness have one or more chronic health conditions. According to the Centers for Disease Control and Prevention (CDC) data, six in 10 adults in the US suffer from some form of chronic disease. It is one of the leading causes of death and disability, and one of the leading drivers of the country’s USD 3.5T annual healthcare costs. An ageing population and changes in societal behaviour are contributing to a steady increase in these common long-term health problems.

Due to COVID-19, chronic disease patients have not been able to travel frequently to receive care and manage their symptoms, both relating to physical fitness and mental health. In this light, digital behavioral health startups that specialize in treating chronic disease patients have been gaining popularity. Chronic disease related behavior management platforms raked in a total funding of around USD 120M in 2020. Omada and Vida Health have been leading in this segment, receiving funding of USD 57M and 25M, respectively.

5. Substance abuse and addiction management as potential growth areas

A study by Blue Cross Blue Shield (BCBS) has revealed that COVID-19 has fueled alcohol consumption by 34%, smoking by 20%, vaping by 17% and use of non-medical drugs by 16%. In another study by Teladoc, there are growing rates of alcohol and substance abuse cases being noted in women, who made up 38% of patients diagnosed in 2020 compared with 24% in 2019.

With economic and financial instability adding further to stress caused by a global health crisis, substance abuse and addiction management is establishing itself as a popular specialty area, with vast opportunities for growth.

Quit Genius, a startup that offers digital cognitive therapy programs to individuals with SUD, raised USD 14M this year. Lionrock Recovery, a telehealth services provider that specializes in substance abuse disorders, raised USD 7M.

Combating challenges in digital behavioral health services

- Access to qualified care providers

A prevalent issue when it comes to digital technologies, is the lack of required skill sets among provider companies. For patients, navigating the healthcare system can be challenging when one is in need of urgent care. Seeing these barriers, companies have expanded the digital behavioral health marketplace and created new tools, simplifying patients’ ability to find the right provider.

For instance, ZenCare’s search optimization platform first vets healthcare providers’ qualifications, curates their profiles, including brief video interviews and professional head-shots to help prospective patients get a better idea about their therapist.

- Concerns over patient privacy

Some people often find it difficult to trust digital behavioral health platforms due to concerns about data privacy. Cyberattacks are not uncommon in the digital world, which makes people skeptical about making a shift from in-person consultations to digital ones. While there are several privacy laws already in place to protect customers who use digital health and telemedicine applications, behavioral health startups should reinforce their data privacy and security measures to win over skeptic customers.

The way forward

While data shows that 2020 has been a standout year for digital behavioral health, there’s still plenty of room for growth. . The industry needs to work together to improve accessibility and usability of these platforms. Furthermore, published evidence of the positive results through digital therapies will give patients and providers a greater push to go digital. The future of this sector may also witness the rise of hybrid treatment options that combine physical and virtual care.

Ultimately, the rise of digital behavioral health offers a critical avenue to not only sustain mental and behavioral health services, but also to expand them beyond the pandemic timeline.

Netscribes offers holistic market, consumer and technology insights for healthcare organizations to help them navigate through the changes in the industry. Contact us, to know more.