The Indian online grocery market is expected to grow at an accelerated pace over the next few years. Netscribes predicts that this sector to be valued at INR 1034.13 billion (USD 14.46 billion) by 2023. Rising investments, record-high smartphone and internet penetration, and continuous innovations are the main factors fueling its market growth. Here is a deep-dive into some of the top growth drivers, challenges and key trends in this domain.

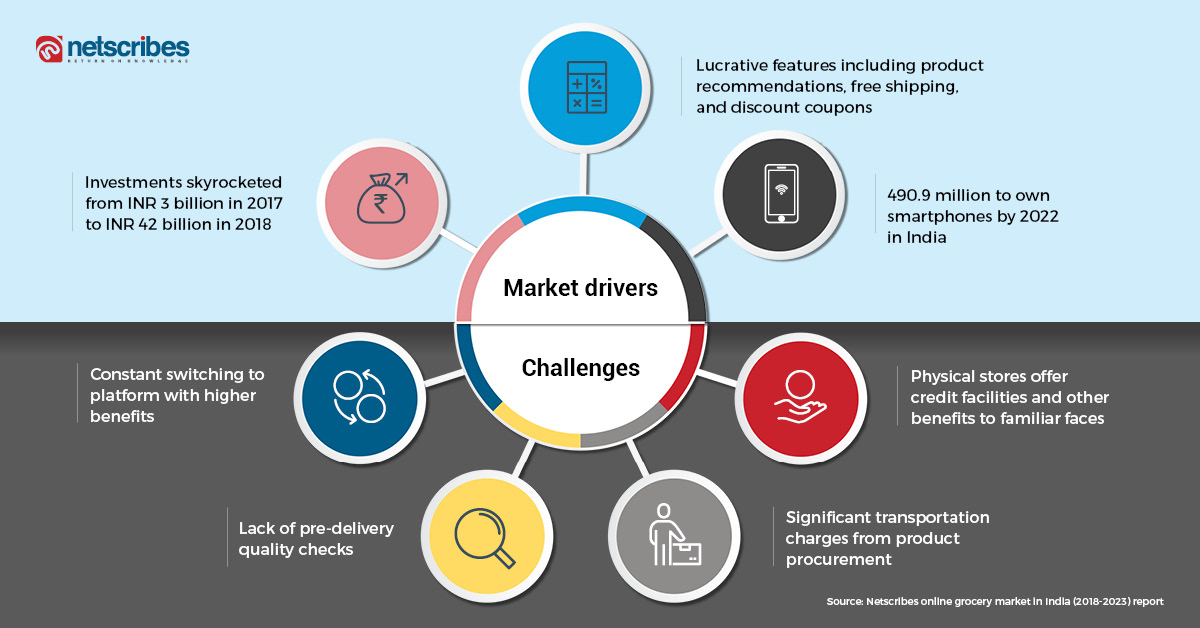

Market drivers

Customer acceptance and high investment

Time-crunched working professionals prefer groceries delivered to their doorstep. Moreover, this savvy and ever-growing group of consumers isn’t shy about spreading the word among friends and families. So while the current market reflects low penetration levels, the future holds high-growth potential. This trend has triggered some major investments in the past few years. To put this into perspective, investments in online grocery firms grew by 14 times from USD 41 million in 2017 to USD 587 million in 2018.

Continuous innovation

E-grocery apps offer tremendous convenience and accessibility for shoppers, such as the ability to order from various vendors through a single interface, live order tracking, and multiple payment options. Indian players such as Big Basket, Freshtohome, ZopNow, Grofers, Nature’s Basket, and Amazon Prime Now have introduced digital wallets.

Others have added price comparison options and allow higher levels of customization at affordable prices. Product recommendations, free shipping, and discount coupons are other key aspects driving user growth across online grocery shopping platforms.

Internet and smartphone penetration

Nearly half the Indian population resides in internet-deficient areas. However, internet users are steadily on the rise, hinting at a slow but gradual take-off of this trend nation-wide. This allows the industry the opportunity to penetrate further to expand to newer geographies. What’s more encouraging, by 2022, 490.9 million are expected to own smartphones.

Challenges faced by the Indian online grocery market

High cost of customer acquisition and increased attrition

The Indian e-grocery market growing immensely crowded and competitive. Increased price competition has given rise to more discount-hunting customers than ever. These shoppers readily switch between platforms that offer the most value in terms of discounts and delivery charges. Ergo, the market is quickly meeting its point of saturation in sales opportunities for both the established and new entrants.

High operational cost for quality maintenance of perishable goods

Perishable goods require more investment for both storage and delivery infrastructure. The lack of quality inspection options before delivery can lead to unhappy customers; especially if damaged or expired products are shipped. Moreover, there are considerable transportation charges incurred from vegetable and fruit procurement and delivery. The combined effect of these increases spending, adversely impacting the e- grocer’s bottom line.

An abundance of physical grocery stores

There are nearly 12 million local physical grocery stores nation-wide, traditionally preferred by Indian families, citing shopkeeper familiarity as the principle reason. These stores thrive due to customer proximity. These days, many offer free delivery, credit facility, and even lower prices for regular customers. They conduct business leveraging the ‘just-in-time’ method, keeping stock of only those items which have a high demand.

Key trends brought about by the Indian online grocery market

Aggressive strategies of online grocery

E-grocers offer shoppers an expansive product selection. Detailed product information, delivery customizations, and a bouquet of payment options are other features that form a part of the package. It’s no surprise why most customers are eager to explore online as a grocery purchasing option. Realizing this, most e-grocers are aggressively campaigning to gain a sizable wallet share of target groups like parents with young kids, young urbanites, tech-savvy online shoppers, and budget-driven shoppers.

Social media marketing for online grocery branding

Like other retail businesses, e-grocers, too, are realizing the power of being active on social media to increase brand awareness and recall. With social media being a two-way marketing channel, players are not just promoting themselves to earn customer loyalty, but are also harnessing it as a source to uncover new business ideas and get a pulse of the consumer to customize and refine their offerings.

Digital dashboards in physical stores

Mirroring the features offered by online grocery shopping platforms, some large brick-and-mortar grocery stores have started to offer customers product data and inventory details instantly, using smart devices like tablets and iPads. Through such digital infrastructure, both the store staff and end-consumers can now view detailed product information and updated stock numbers.

Dynamic pricing

With the advent of online grocery retailers and price comparison apps, large-scale brick-and-mortar firms are using advanced analytical capabilities to augment product prices throughout the day. It enables stores to compete with their online counterparts, thus, increasing chances of landing at the top of online search results for ‘price comparison’. Real-time pricing policies are also being used by offline grocers to push sales during slow growth hours.

As shoppers constantly seek newer avenues of seamless and value-added e-grocery shopping, it’s becoming imperative for players to put their best foot forward. Netscribes gears both brands and e-grocery players with comprehensive consumer market insights and catalog management solutions to help boost their growth. To request a consultation, contact us today.

For in-depth research and analysis of the Indian online grocery market, connect with us at info@test.netscribes.com.