Startups add a value of over USD 3 trillion to the global economy. Global venture investments have hit the USD 300 billion mark for three consecutive years (2018-2020), and the trend is expected to continue with investments of USD 125 billion recorded in the first quarter of 2021. Unicorn startups are quickly sprouting with an average of close to two new unicorns per working day. This increase in the investment trend is largely attributed to technology-driven startups, which account for at least seven out of every ten companies.

The growing demand for solution-driven innovations

Innovative startups are problem solvers with the capabilities or a vision to devise targeted solution frameworks for specific challenges in the subject domain. For example, innovators provided breakthrough solutions in 5G and satellite communication with metamaterials-based antennas. Reinforcement learning startups are changing the way autonomous systems operate across industries. New event-based system providers are replacing conventional frame-based camera systems in various applications requiring low-power, on-the-move, and fast processing speeds. Innovative solid-state LiDAR providers are enabling safer and cost-effective options for autonomous vehicles.

A conducive environment or an active ecosystem is a prerequisite for the growth of such startup companies. Incubators and accelerator programs are sector agnostic and are catalyzing startup growth exponentially. To date, more than 80 ecosystems globally, have produced a billion-dollar startup or a unicorn. Therefore, it is imperative to understand the dynamics of a startup ecosystem before investing in potential areas of interest.

Over the past few years, there has been a huge influx in the number of startups. Although the COVID-19 pandemic may have disturbed the flow briefly, the innovation and the commercial cycles are getting back on track in most regions as the curve flattens. The uptick in the number of startups entering an industry shifts its dynamics significantly in terms of innovation, emerging technologies, investments, M&A, and realigned business activities.

Identifying valuable differentiators is a persistent challenge

Incumbents, new entrants, innovators, enterprises, and potential investors find it increasingly challenging to pinpoint valuable startups with promising prospects. They need to identify such startups at different stages of development to tap into potential growth opportunities. Given the current market scenario, the key requirement is to focus on decluttering the crowded startup space to spot potential game-changers and breakthrough companies.

A holistic study of the innovators, industry challenges, and the evolution cycle in the domain helps highlight relevant opportunities for building strategies. Add to it a systematic and comprehensive approach combined with insights from subject matter expertise ensures accuracy of the analysis.

How a startup ecosystem analysis can help

Companies are adopting a structured framework to ensure the coverage of all the essential aspects required for a startup ecosystem analysis. The scoping step that involves a thorough study of the subject technology or the area of interest, is performed to outline all the essential components including technicalities, use cases or applications, and business models.

At the data collection stage, comprehensiveness is ensured in building the list of startups. This forms the base of the analysis. For a mature domain, the count of startups being high requires filtering and shortlisting based on various parameters associated with the objective of the study. Whereas for niche areas that are disruptive or futuristic, only a limited number of startups are available. In such cases, an expanded search is required with author-based probing of ventures, backtracking of companies from patent filings, anticipating spinout possibilities from research projects, and identifying stealth mode startups.

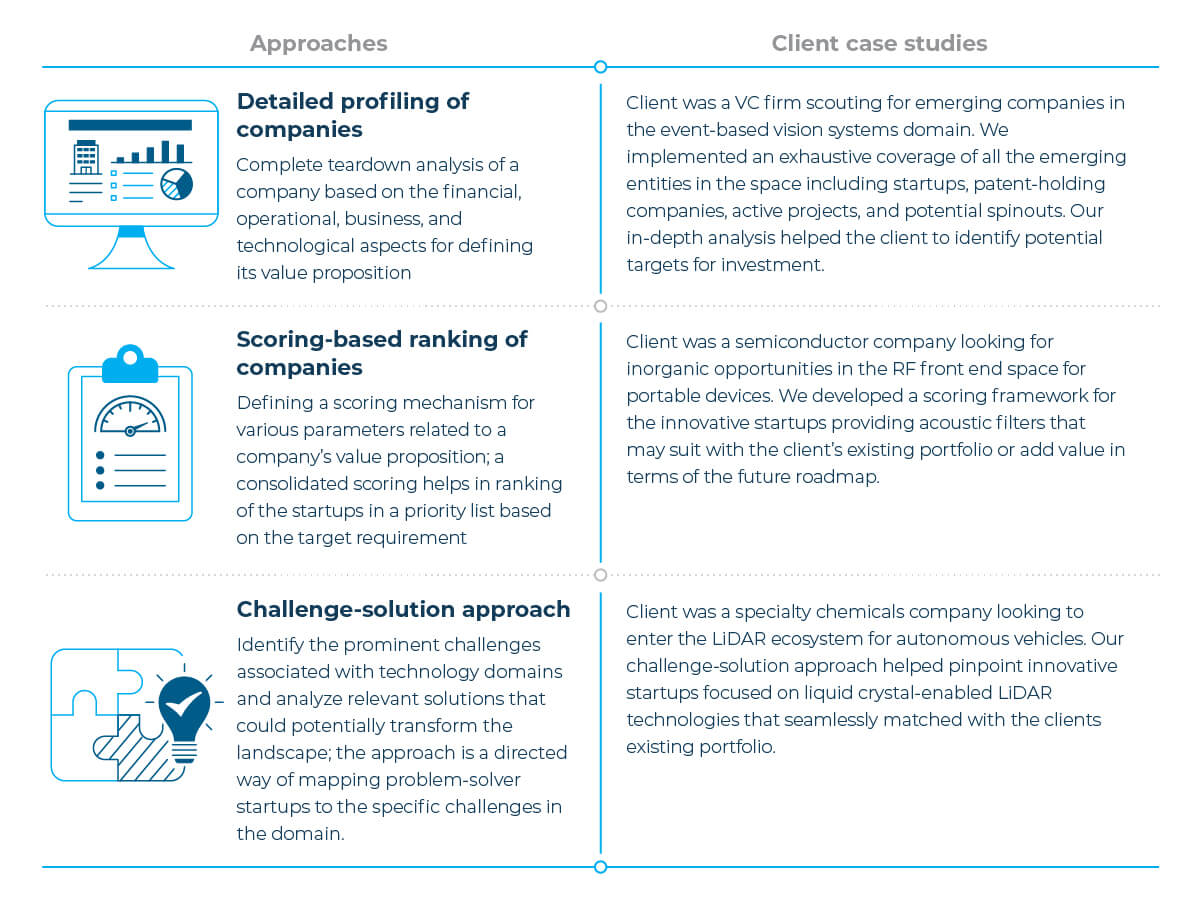

Startup ecosystem analysis can be divided into various sub-analysis, approaches, or practices based on the problem area in focus. At Netscribes, we break down the client problem statement to map different blocks of the startup ecosystem analysis as per the client’s requisite. Some cases can be served with one extensive and elaborate approach targeting the challenges at hand, whereas many others require a combination of different approaches to arrive at a holistic picture. The approach selection and consolidation depends also on the quantitative and qualitative mix of insights needed to make strategic investment decisions.

Based on the objective of the study, Netscribes determines the most suitable combination of approaches to deliver optimum results. Broadly, we divide the components of a startup ecosystem analysis into three:

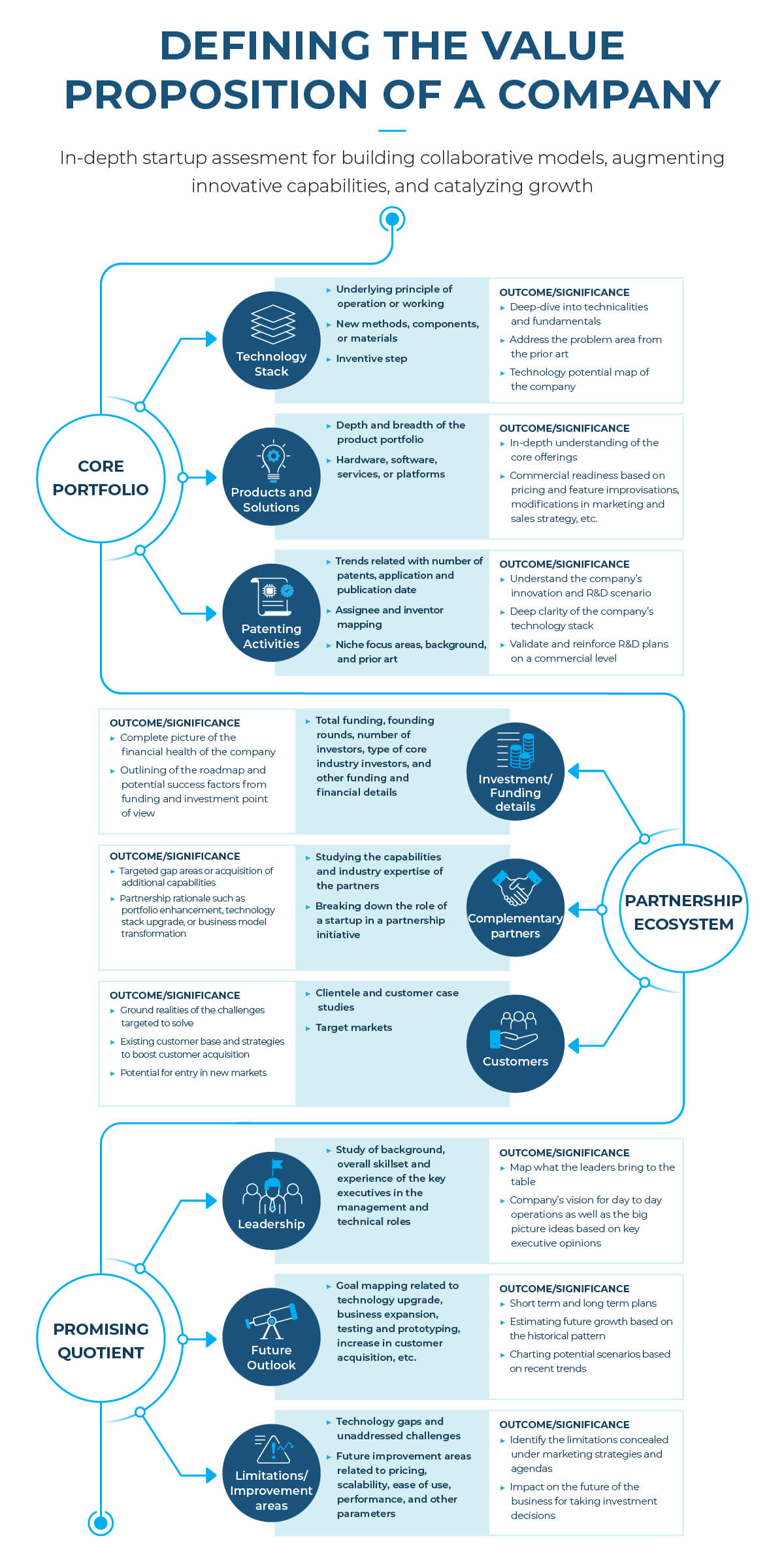

The customer case studies correspond to standalone approaches, but also feed into each other for mutually reinforcing the overall insights. In most cases, detailed profiling and scoring of startups consider a similar set of parameters for analysis with the key difference being the qualitative and quantitative nature of the two. In the below flowchart, we delve into the approach and methodology followed for profiling a startup in detail to outline the building blocks of a company and determining its position in the market.

For over 20 years, Netscribes innovation research has been arming organizations with consistent data-driven insights to capitalize on disruptive innovations in a timely and cost-effective manner. Through a combination of patent analysis, technology assessments, and qualitative and quantitative research, we support you through every step of the innovation process – from determining the novelty of your inventions to commercialization. To know more contact us.