Customer experience is taking the center stage across industries. Marketers are experiencing immense pressure to correlate customer satisfaction levels with revenue growth. With over 80% companies expecting to compete chiefly on this aspect, measuring it to draw accurate and practical insights is imperative. While such evaluations generally provide an idea on satisfaction and loyalty levels, the concerns of a marketer go beyond these. The ultimate question they seek to answer is “Will this customer recommend our brand to others?”

That’s exactly what a Net Promoter Score(NPS) survey does. The NPS survey has turned into a global standard for measuring customer experience. With customers growing increasingly weary of filling out lengthy and complex survey forms, NPS has become the new go-to survey strategy employed by a bevy of brands both small and big.

What is an NPS survey?

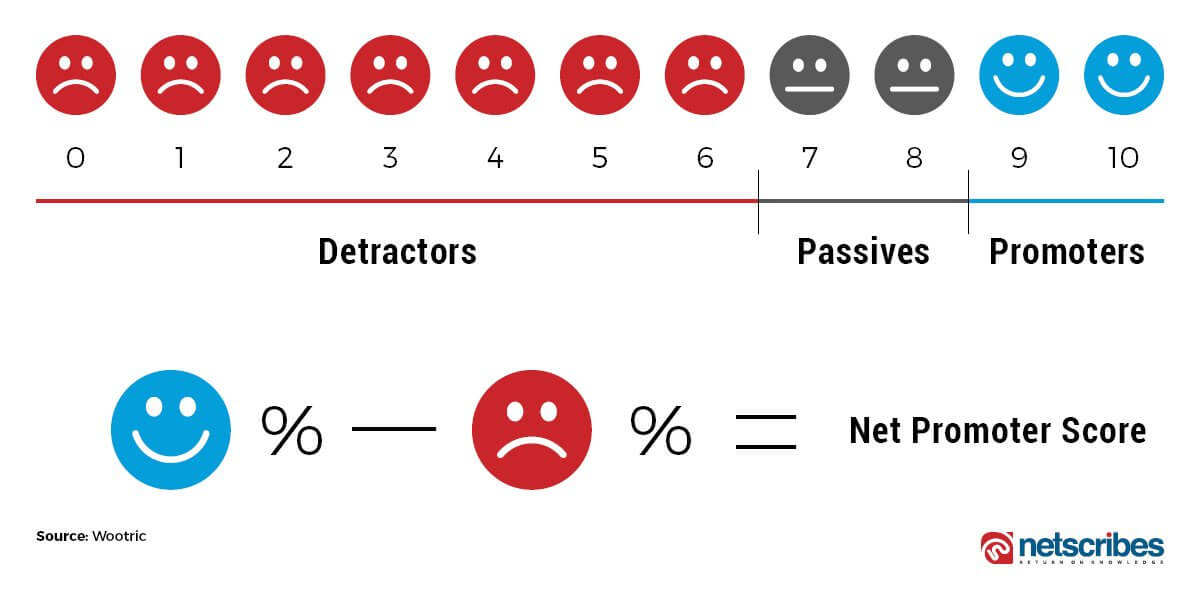

An NPS survey asks a single question – “On a scale of 0-10 how likely are you to recommend X company’s product or service to a friend or a colleague?” Based on their rating, customers are then classified into 3 categories: detractors, passives, and promoters.

Detractors (score 0-6)

These are not particularly impressed by a brand’s offerings. Considered as unhappy customers, they can cause plausible damage to a brand’s image through negative word-of-mouth.

Passives (score 7-8)

While satisfied, these customers are not enthusiastic enough to spread a positive word about your brand. They are also vulnerable to competitor offerings.

Promoters (score 9-10)

These are loyal customers who can be passionate evangelizers for your brand. Their loyalty and advocacy can help you attain a positive brand health score.

Once you have these numbers, determining your Net Promoter Score (NPS) is easy. Simply subtract the percentage of detractors from the percentage of promoters. This will leave you with a score between -100 and 100. For example, if the promoter percentage in your company is 80%, the passive percentage is 30%, and the detractor percentage is 20%, the NPS score for the company will be 80-20=60. Usually, a score between 50 and 80 is considered as a benchmark, reflecting that your brand is growing efficiently.

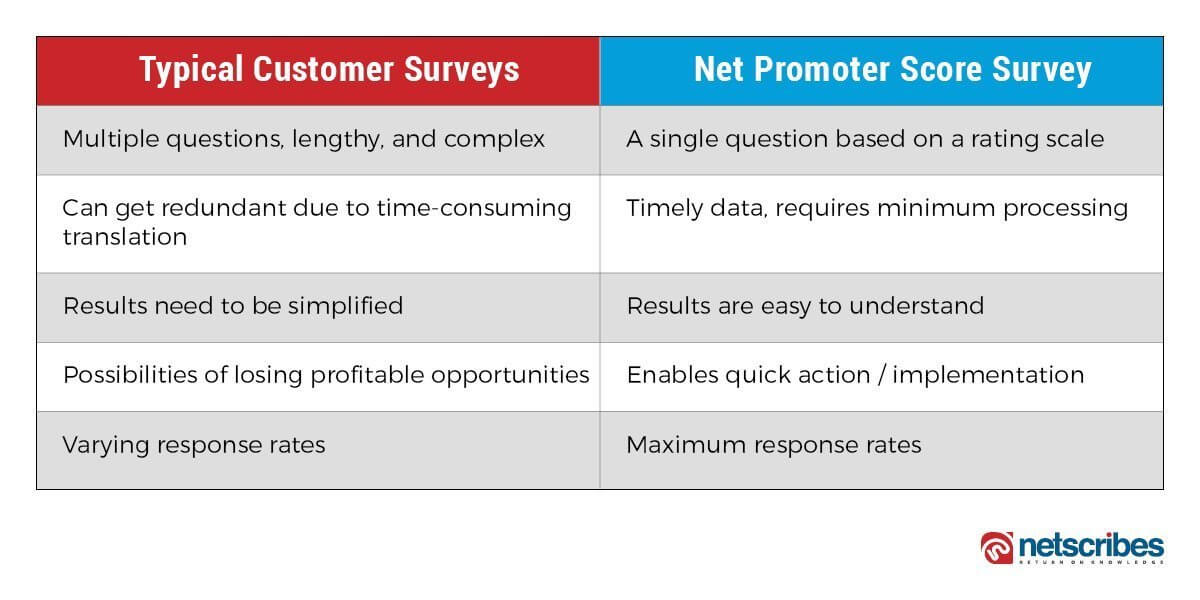

Here’s how an NPS survey stacks up against routine customer surveys:

Now that we explored how NPS works, here are a few quick tips to help you get the most out of your study.

Timing is everything

For any feedback survey to be accurate, knowing when to meet your customers with it is crucial. For instance, a hotel seeking to understand how their room service is faring, shouldn’t wait to shoot the survey a week after the customer has checked out. Given such a time-lapse, the rating provided by customers is bound to average out the entire stay experience.

Similarly, not all stages of the experience are perceived as equal by a customer. For companies seeking to improve their NPS score, knowing the high and low points of the experience process is a must.

For instance, instead of asking for a rating right after a customer has made a purchase, an e-commerce store will be better served to conduct the survey after notifying the customer of a promised cashback being credited into their account. Therefore, understanding the feel-good spot is critical in garnering a good NPS result.

Randomize your target respondent

Some businesses may have a longer customer experience process than others. Let’s go back to the hotel example. A customer may have booked a reservation online, checked-in a couple of days later, stayed, probably lunched at the hotel’s restaurant, and checked out.

Asking for feedback across different stages of the experience to the same customer may often create survey fatigue. Because NPS is a one-question survey, it can be randomized across different customers, scaled across different locations at different stages of the experience value chain. Thus, it bestows marketers with unbiased, holistic, and in-depth data layered with multiple action points to improve their experience.

Benchmark for competitive insights

For companies to truly discern the loyalty they draw in a marketplace, understanding their competitive position is key. This would typically require a market research agency to conduct a survey on your target customers.

The survey structure, in this case, will be slightly different. For instance, if company A seeks to measure its NPS relative to its competition, the survey would be divided into 2 parts:

1. Do you currently use products/ services of any of the following companies?

- Company A (Yes, No)

- Company B (Yes, No)

- Company C (Yes, No)

- Company D (Yes, No)

Next, for each “Yes”, the respondent would be asked:

2. On a scale of 0-10 how likely are you to recommend Company A /Company B /Company C /Company D to your friends, family or colleagues?

This will help the company understand whether its NPS score is good or bad.

Ensure KPI alignment

Customer satisfaction (CSAT) is one of the most common KPI for organizations across industries. An NPS survey can be an ideal tool to capture this data, given how satisfaction triggers loyalty and eventually inspires advocacy.

In order to truly gain meaningful insights from an NPS study, companies should work backward based on the product or service areas central to their performance and plug in the survey at the right junctures. This will help marketers better pinpoint weak links that demand immediate attention or action.

Apart from this, companies must also aim to understand their customers’ channel preferences whether text, email, or calls and choose the medium that will garner the best response rates. At the end of the day, it is sustained brand loyalty that gives birth to enthusiastic promoters. The path to profitability ultimately lies in understanding how to multiply promoters, minimize detractors and make your NPS number as transparent as possible throughout your organization.

Netscribes is a global data and insights leader, helping organizations to understand and meet evolving business needs. To know more about our consumer research and insights solutions, contact info@test.netscribes.com