Again, it’s that time of the year when we are surrounded by an air of excitement and cheer. Only this time, it’s quite different. Even as the economy steadily reopens, the pandemic continues to carve out permanent shifts in how, what, when, and where consumers buy.

A holiday shopping predictions report by CBRE states that brick-and-mortar retail sales will decline but e-commerce sales will witness a year-over-year growth of at least 40% between November and December in the US. In the UK, over 70% of shoppers plan to complete their holiday purchases online.

For many retailers, this quarter will be one that determines whether they sink or swim in the near post-pandemic future. Therefore, navigating these uncertain times will need an unprecedented approach. To help you get a grip of what’s in store, we did a quick pulse check and sieved the top five holiday shopping predictions emerging across many parts of the world:

1. New passions will drive purchases

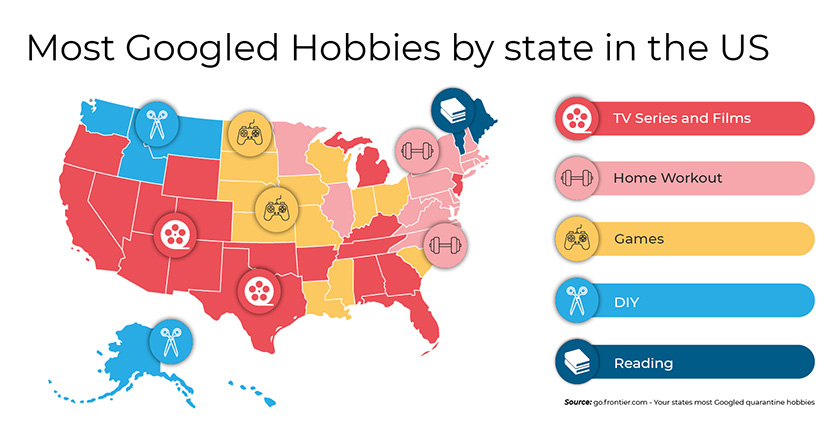

With people hunkered down, more time on their hands and the hunger for new experiences has inspired many to pursue different hobbies. In the UK, baking (20%), gardening (20%), DIY or home improvement (14%), sport or fitness (14%), board games or jigsaw puzzles (10%) were the top hobbies encountered. Similarly in the US, watching TV series and movies, home workout, video games, DIY and reading were observed as the most popular pass-times.

Studies suggest that 75% of those who pursued a new hobby plan to continue with it at least for the rest of the year, indicating that these interests can influence their holiday wish lists. For retailers to win, creating campaigns on the latest shopper data will enable them to stay relevant to evolving customer preferences. Tuning in to online signals based on the category, geography, and sales channels you use will help pull the right marketing levers to induce timely conversions.

2. Shipping and returns could make or break brand loyalty

In hindsight of the delivery anxieties caused by the early days of the pandemic, people began their holiday purchases as early as July. And with good reason, because this holiday season approximately 700 million gifts are at the potential risk of not arriving in time according to Salesforce. The study also states that shoppers are expected to return USD 280 billion worth of global e-commerce orders, accounting for 30% of all purchases made during the season.

Past holiday shopping predictions reveal that 34% of Americans who receive gifts during the holiday season tend to return or exchange them right after the holidays. Such drifts pile reverse logistics pressure on retailers eager to turn these customers into repeat purchasers. To minimize such inconveniences, enriching product detail pages with accurate information helps reassure customers that the products will arrive as described on your website.

Moreover, sites offering store pickup, curbside, inside, drive-through, are expected to see a 90% increase in digital sales over the previous holiday season. E-commerce players would do well to consider laying out contactless pop-up stores to reduce dwell time and create a memorable last-mile experience, spurring customer loyalty.

3. Shopping will go online, yet stay more local

In the UK, 53% of shoppers are eager to support local businesses this year, with 55% agreeing that, if possible, they will do at least some of their Christmas shopping in physical stores. According to Think with Google, searches like ‘picking near me’, ‘patch near me’, ‘orchard near me’ are growing globally by over 100% YoY. Plus, with Small Business Saturday (SBS) being celebrated as a national US holiday, it further echoes the sentiment of supporting local businesses. In fact, 46% of shoppers surveyed in the US agreed that they make a deliberate effort to shop at businesses that align with their values.

As brands and retailers looking to harp on the local business limelight, our holiday shopping predictions for this season convey that you would do well to promote your credentials that support consumer demands. Another interesting finding by Deloitte stated that close to half of the shoppers, while apprehensive of shopping in-store, don’t mind making purchases from stores outside malls.

4. BFCM (Black Friday/Cyber Monday) might just be month-long affairs

As holiday sales stay grounded online, whether BOPIS (buy online and purchase in-store) or delivered to the doorstep, the BFCM weekend is quickly transforming into a month-long event this year. For instance, instead of presenting a single day with incredible deals, Walmart is spreading out its Black Friday savings to three events across November. Home Depot also made a similar announcement of starting their Black Friday savings and discounts in early November and going through all of December.

While concerns around product availability and financial limitations have already translated into an earlier shopping season, some cohorts are expected to push their purchases until December to score on the best deals. According to a Digital Commerce 360 study, 68% of shoppers will finish up their holiday shopping in December. Savvy retailers are already scheduling their promotional strategies in a way that capitalizes on this entire holiday period.

5. Marketing communications are expected to be realistic, safety-centric, and sprinkled with gifting ideas

At the end of the day, looking beyond competitive deals, people care about the brands they love. They want to know what you are doing in terms of safety (both for customers and employees), community support and spreading the holiday cheer. Ads that are reassuring, informative, entertaining yet in touch with reality will be well received.

Another key holiday shopping prediction being observed is that most shoppers are stumped on gifting ideas and hoping for retailers and brands to provide some inspiration. According to Morning Consult, Americans are more likely to buy from companies that offer gift ideas. Therefore, retailers would do well to segment their products for specific buyer personas and create gifting guides for all budget ranges.

As this tumultuous year draws to a close, shoppers are looking to indulge themselves, even as they pamper their loved ones. Thus, self-gifting is another lucrative positioning factor for brands hoping to cash in on the idea of shoppers in treating themselves, even if it means something small and budget-friendly.

With so much happening and so swiftly, surviving this holiday tide will need retailers to keep an eye on what’s happening in the now, and know exactly what to look for to earn and exceed their Q4 sales targets. For more predictions check out our latest holiday season infographic. To know how you can sharpen your holiday strategies to maximize online performance, now and in the future, contact us.