Demand for advanced driver assistance systems (ADAS) is expected to gain momentum in the coming years. Regulatory and consumer interest in safety applications to reduce accidents are anticipated to fuel this trend. By 2023, Netscribes estimates the ADAS market to be worth USD 31.95 billion. Moreover, drivers with past experience of using ADAS systems are overwhelmingly inclined to repurchase. Some key reasons for its popularity include features ranging from assisting drivers in eliminating human errors to a bird’s-eye display of the surrounding area.

Although the ADAS is still in its infancy, many believe that its impending proliferation can pave the way for vehicles for a completely autonomous world. In this article, we will take a deep-dive into some of its growth drivers, challenges, and key trends.

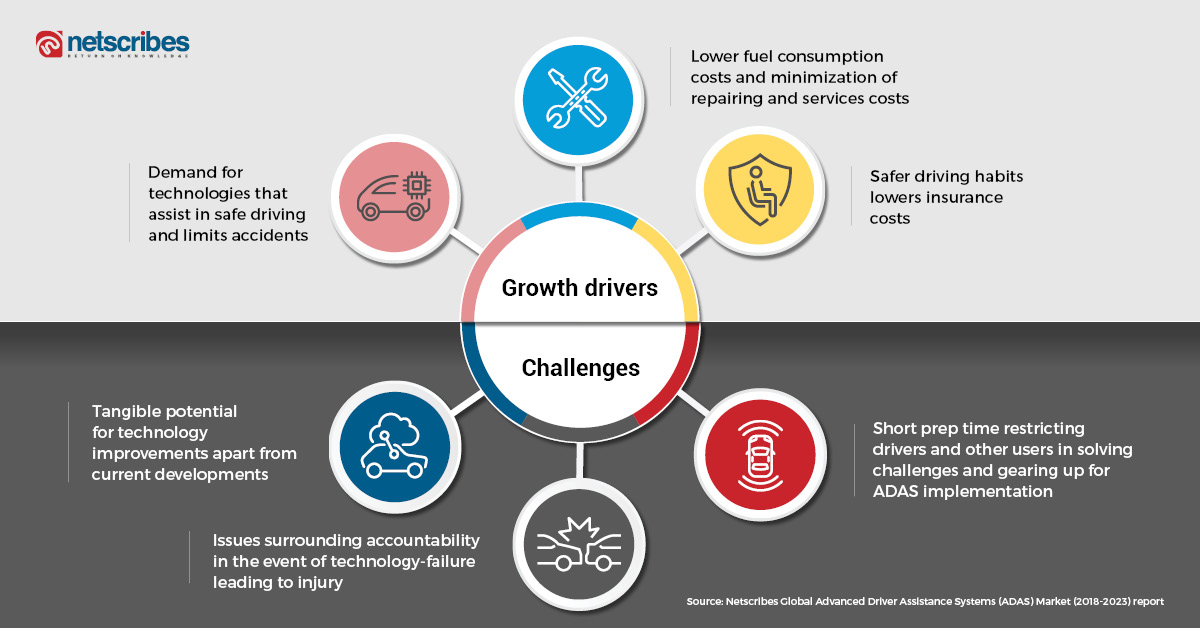

Growth drivers

Limiting chances of accidents

ADAS offers crash avoidance technologies which can minimize accidents as well as enhance the convenience of driving. Sophisticated advanced sensor systems provide a 360-degree view of the route at all times, thereby lowering the possibilities of a potential accident. Also, advanced electronics coupled with powerful software assist drivers in avoiding judgment errors. ADAS alerts drivers to lower speed or change relative-vehicle position or trajectory by communicating with other drivers on the road using indicator lights. This helps tangibly limit the possibilities of accidents.

Cost reduction

Aside from deadly accidents and higher insurance costs, bad driving also takes a toll on fuel consumption. Poor driving habits such as speeding and hard braking can waste fuel, incurring up to 33% in extra fuel costs. ADAS alerts can help a driver use less fuel, boost efficiency, and save money. Lesser crashes can also minimize repairing and services costs.

Insurance

Insurance costs can rise due to poor driving habits. But as ADAS evolves, drivers will be able to surrender more and more of their driving responsibilities to these systems. Therefore, when accident claims arise, they will more frequently include the vehicle manufacturers and the ADAS suppliers as defendants – a more trustworthy clan than human drivers. Thus the car’s liability will shift from the driver to the manufacturer.

Challenges facing the global ADAS market

Dependency on technology

Semiconductors play an integral role in ADAS. Despite significant progress made in this industry, scope for improvement abounds. For instance, forward-collision warning systems still have difficulty identifying objects when a vehicle is traveling at high speeds. Parking sensors have a disadvantage – inability to detect obstacles that are not easily visible due to their flatness to the ground level.

Calibration

A normal vehicle service doesn’t involve calibration of the ADAS technology. But currently, there are talks of making it a part of MOT to ensure smooth functioning in the near future. There are issues, however, about accountability in case the technology fails and leads to injury. Therefore, ensuring everything is well-calibrated and functioning accurately is something that currently falls within the purview of the fleet manager.

Implementation

The rapid pace of ADAS availability in the market has not allotted sufficient time for drivers, operators, dealers, and insurers to solve challenges and be primed for its implementation. Some of the pertinent questions about the ADAS include: which options to choose from, how to train with the systems, and how far these go to limit the possibility of risk. The dangers of over-dependence on ADAS systems need to be addressed by fleet managers.

Key trends in the global ADAS market

Embedded vision

Automotive vision systems are essential for identifying and tracking potential hazards. They provide critical inputs for high-level warnings such as lane drift or unobserved traffic. Additionally, they also provide the data required to support an increasing array of services including automatic parallel parking or traffic sign recognition for speed-change alerts. Thus, vision systems are known to provide the base for driver monitoring systems.

For example, the Avnet Blackfin Embedded Vision Starter Kit combines development software and debug tools with an evaluation board which includes Analog Devices’ specialized BF609 Blackfin vision processor, a camera and peripherals.

Automotive HMI design

The touch-free HMI systems allow driver interactions without the need to take their hands off the steering wheel. Along with voice-operated systems, more precise driver monitoring systems using eye-tracking technologies continue to close the gap with traditional touch-based interfaces. Head-up displays (HUD) promise to help drivers maintain roadway focus, using imaging devices such as Texas Instruments’ digital light processing (DLP) chips to project high-contrast images.

Sensors

ADAS requires an extensive set of sensors for monitoring the vehicle’s immediate surroundings and even that of the drivers. Semiconductor manufacturers deliver increasingly sophisticated ICs that integrate sensor-signal chains needed for signal processing and conditioning.

For example, designers can implement core features of a LIDAR system by combining a laser with the Maxim Integrated MAX3806 optical-distance measurement IC and Maxim’s MAX1446 high-performance analog-to-digital converter. Along with signal-chain integration, the trend towards enhanced sensor fusion combines the output of different sensor types with additional information to provide more predictive warnings.

Connectivity

New trends such as automated predictive maintenance systems and the Internet of Things (IoT) promise to link smart devices within vehicles with cloud-based applications to provide even more sophisticated services. Along with critical driver assistance systems such as tire-pressure monitoring and anti-lock braking systems, wireless options offer greater flexibility for standard automotive communications protocols such as FlexRay, CAN, and XCP among others.

For an in-depth market competitive analysis and technology research on the global advanced driver assistance systems market, contact info@test.netscribes.com